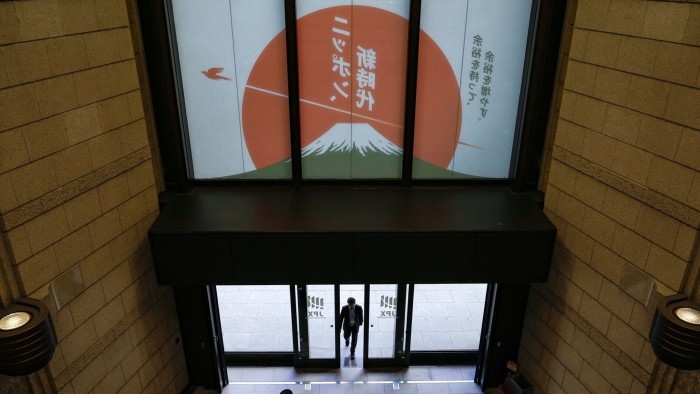

With the pace of governance improving, Japan's stock buybacks almost triple

Free updates are notified at any time

Just register Japanese Business and Finance Myft Digest – Deliver directly to your inbox.

The share buybacks announced by Japanese companies in April almost tripled in the previous year as the board chose to relax investors' tariff uncertainty on holding dry powder for investors to be assured.

The groups listed in the Topix benchmark are collectively referred to as April’s buybacks ($27 billion) repos, remitted from 1.3tn the same month last year, according to Goldman Sachs. This brings the total to 690 million yen so far this year, more than double the figure at the same time in 2024.

The huge growth in Japan's first month of fiscal year comes after a record 20 yen repurchase in fiscal 2024, which analysts describe as a “government shift” in corporate cash hoards and balance sheet management approaches.

Investors have historically accused Japanese companies of inefficient balance sheets and equity returns.

But Hiromi Yamaji, CEO of Japan Exchange Group, which runs at Tokyo Bourse, said the group began to think more carefully about its capital structure, including if there is a lack of effective ways to return it to shareholders, they returned it to shareholders.

“We’re entering a completely different world,” Yamaji, a key figure in Japan’s push for stronger corporate governance, told the Financial Times. “So, in other words, whenever (the company) thinks its share price is too low, they are trying to use opportunities to manage their equity size.”

Japan's largest investment bank and broker Nomura, as well as Hitachi and Komatsu of the Mitsubishi Trading Building and Manufacturing Consortium, recently announced a buyback of hundreds of millions of yen.

The April repurchase spanned industries including automobiles, capital goods, insurance, telecommunications and banking, despite Prime Minister Shigeru Ishiba's announcement of trade policies against U.S. President Donald Trump.

U.S. tariffs have reached Japanese auto exports, and could create greater unrest if negotiations fail to reduce the broader “reciprocity” taxes threatened by Washington.

But, Bruce Kirk, a Japanese equity strategist at Goldman Sachs, said large buyback data showed that despite all the uncertainty caused by tariffs and recession fears, there is still a driving force for shareholders’ corporate governance push.

“Together with the announcements of large corporate structures of some Japanese blue chip stocks this month, there are many things worth affirming,” Kirk said.

Jefferies quantitative strategist Shrikant Kale said he hopes the momentum will continue, given that other listed Japanese groups still have a large amount of cash and stock overdose.

“I forecast a total buyback for this fiscal year of ¥22tn. The only risk is the sharp decline in global growth caused by tariff uncertainty, forcing the company to return to its preservation model,” Kyle said, adding that he did not see any signs that have happened so far.

While investors urged the company to go far beyond the “vanilla” option to enhance shareholder support, buybacks emerged. They called on groups to overhaul the board and sell non-core assets.