With the influence of Trump on the prospects, bond traders will turn the focus to the Federal Reserve

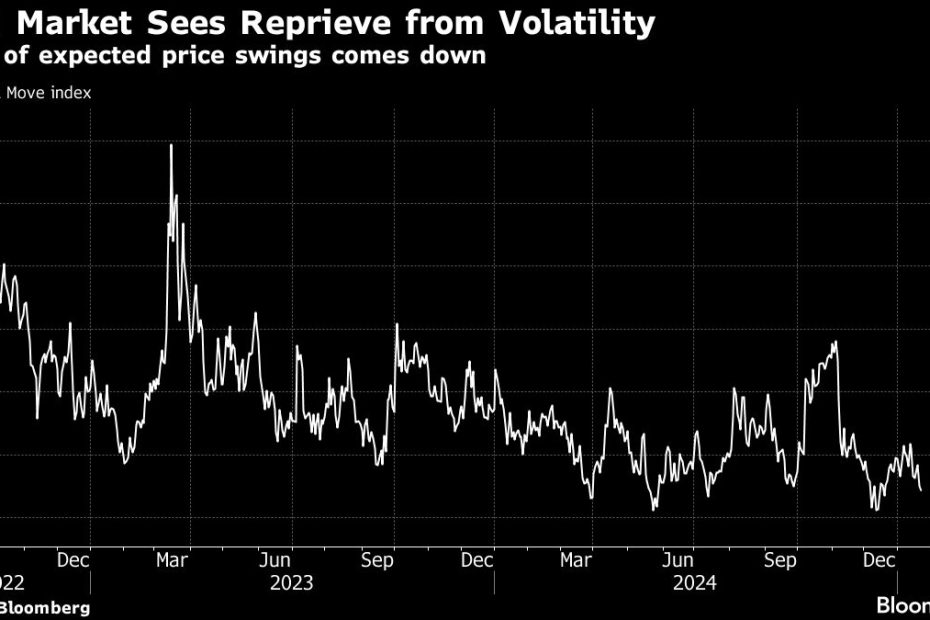

(Bloomberg) -In the first week of Donald Trump in the bond market, at least the first week of Donald Trump, as a result, it was far from being worried as unstable. The same is true of traders who want the Federal Reserve to change.

Most reads come from Bloomberg

It is generally expected that the Federal Reserve will maintain interest rates at the end of the two -day meeting on Wednesday, which marks its first suspension of the interest rate cut cycle since September.

However, since the end of last year, the yield has risen sharply, because traders have speculated that Trump's policy will exacerbate inflation pressure and inject power to the already tough economy, so it has greatly adjusted the expectations of monetary policy. If the Fed Chairman Jerom Powell emphasizes its typical dependence data and maintains the current moderate market's mild interest rate cuts, it may bring more relief to the market.

Neuberger Berman's fixed income joint chief investment officer Ashok Bhatia said on Bloomberg TV: “The Fed may be reduced twice this year, or even once.” “If you get this from the Federal Reserve, again Coupled with a little deficit stability, this is a very strong result for the bond market. “

The US Treasury bond market has begun to recover from in -depth selling. The selling rate has pushed the yield back to the peak touched at the end of 2023, and once threatened the stock market's record.

The consumer price index announced on January 15 was slightly lower than expected, which relieved people's concerns about the re -ignition of inflation, and began to improve.

Trump made progress in the first week of his office. At that time, he postponed the measures that immediately raised tariffs and stated that he might seek tariffs on Chinese imported products more milder than the recommended period of the campaign. This alleviates people's concerns about the sharp rise in import prices. The sharp rise in import prices will bring another inflation impact or disrupt the economy due to the trade war.

JP Morgan Asset Management Company's investment group manager Priya Misra said: “About a week ago, the interest rate market felt a bit unstable. The situation is eased. “

Bloomberg strategist said this …

“The strong labor market and rising inflation usually indicate that the yield of bonds is constantly rising, especially at a long end of the curve, because the volunteer police officer requires higher risk premium. It also shows that the Fed may need to take a longer period of time Maintain high interest rates to cope with the potential inflation pressure caused by the strong economy. “