If you say the name Donald Trump at Chinese wholesale markets and trade fairs, you will hear faint laughter.

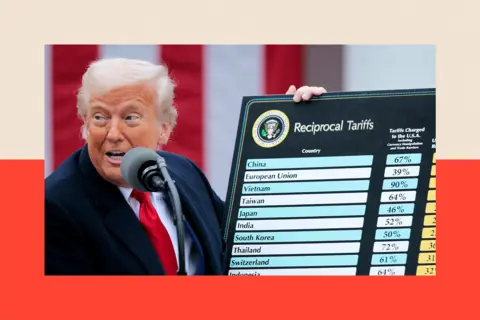

The U.S. president and his 145% tariffs did not instill fear among many Chinese businessmen.

Instead, they inspired a large army of Chinese nationalists to create mocking memes in a series of viral videos and reels – some of which include AI-generated President Trump, Vice Chairman JD Vance and Tech Mogul Mogul Elon Musk to work hard on footwear and iPhone assembly lines.

China is not behaving like a country facing a painful economic prospect, and President Xi Jinping has made it clear that Beijing will not retreat.

He said this month: "For more than 70 years, China has relied on self-reliance and hard work... It has never relied on gifts from anyone and is not afraid of any unreasonable suppression."

His confidence may be partly because China's dependence is far less than exports to the United States 10 years ago. But the truth is that Trump's marginal surgery and tariff hikes are driving pressure points that already exist in China's own struggling economy. Due to the housing crisis, job insecurity and aging population, Chinese people are simply not spending as much as their government wants.

Xi Jinping came to power in 2012 with his dream of China. Now, this is a rigorous test of our tariffs. Now, the question is whether Trump’s tariffs will curb XI’s economic dream or can they turn existing obstacles into opportunities?

Xi Jinping's domestic challenge

Theoretically speaking, China's population is 1.4 billion, which is a huge domestic market. But there is a problem. They seem reluctant to spend money when the country's economic outlook is uncertain.

The trade war is not causing this, but the collapse of the housing market. Many Chinese families have devoted their lifetime savings to their homes, just watching prices plummet over the past five years.

Even if the real estate market collapses, housing developers are still building. It is believed that China's entire population will not fill all the empty apartments in the country.

Former former deputy head of the China Statistics Bureau, admitted that two years ago, the most "extreme estimate" was that there are now enough vacant houses that can accommodate 3 billion people.

Getty Images

Getty ImagesTraveling to the Chinese provinces, you will find them scattered with empty projects - towering concrete shells that are marked as "Ghost City". Others have been installed, the gardens are landscaped, and curtains framed on the windows, and they seem to be filled with the promise of a new home. But only at night, when you can't see the lights, can you tell that the apartment is empty. It's just that there aren't enough buyers to match this level of construction.

Five years ago, the government took action to limit the amount of funds developers could borrow. However, according to a February poll, analysts expect house prices to fall by 2.5% this year due to losses in housing prices and consumer confidence in China.

It's not just the middle-class Chinese families that worry about housing prices.

They are worried about whether the government can provide them with pensions - over the next decade, about 300 million people aged 50 to 60 will leave the Chinese workforce. According to the 2019 estimates from the state-owned Chinese Academy of Social Sciences, government pension funds may run out of currency in 2035.

Also worried about whether their son, daughter and grandson can find a job as millions of college graduates struggle to find a job. According to official data released in August 2023, more than one-fifth of 16 to 24 people in urban areas are unemployed in China. Since then, the government has not released data on youth unemployment since.

EPA -EFE/REX/Shutterstock

EPA -EFE/REX/ShutterstockThe problem is that China cannot simply flip the switch and move from selling the goods to the United States to selling them to local buyers.

Professor Nie Huihua of Renmin University said: "Given the economic downward pressure, it is impossible to significantly expand domestic spending in the short term."

“It will take time to replace exports with internal demand.”

Professor Zhao Minghao, deputy director of the Center for American Studies at the University of Fordan, said: "China has no high expectations for talks with the Trump administration... The real battlefield is to adjust China's domestic policies, such as increasing domestic demand."

To restore the economic slowdown, the government announced billions of dollars in childcare subsidies, increased wages and better paid leave. It also launched a $41 billion plan to offer discounts on items like consumer electronics and electric vehicles (EVs) to encourage more people to spend. However, Professor Zhang Zhuen, Dean of Economics at Fudan University, believes that this is not "sustainable".

“We need a long-term mechanism,” he said. “We need to start increasing the disposable income of residents.”

This is urgent for XI. His dream of prosperity sold when he was in power 13 years ago did not become a reality.

The political test of XI

Xi Jinping also knows that China is frustrated with their future. For the Communist Party, this could give greater trouble: protest or turmoil.

Freedom House’s report on Chinese dissident guardians claimed that over the past few months, protests driven by economic dissatisfaction have increased significantly.

All protests were quickly conquered and censored on social media, so it is unlikely that a real threat to XI is currently posed.

"Everyone can do well only when the country performs well, and the country performs well," Xi Jinping said in 2012.

This promise was made when China's economic rise seemed unstoppable. It looks uncertain now.

Getty Images

Getty ImagesWhere the country has made great strides over the past decade, it is part of the advanced manufacturing sector, including consumer electronics, batteries, electric vehicles and artificial intelligence.

It competed with chatbots DeepSeek and Byd for the US technology advantage, beating Tesla last year to become the world's largest electric car maker.

However, Trump's tariff threatened to throw a wrench.

For example, restrictions on selling key chips to China include the recent tightening of exports from U.S. chip giant Nvidia, aiming to curb XI's technologically-first ambitions.

Still, Xi Jinping knows that Chinese manufacturers have decades of advantages, so American manufacturers are struggling to find infrastructure and skilled labor on the same scale as elsewhere.

Turn challenges into opportunities

President Xi Jinping also tried to use the crisis as a catalyst for further change and to find more new markets for China.

"In the short term, some Chinese exporters will be greatly affected," Professor Zhang said. "But Chinese companies will actively adjust their export destinations to overcome difficulties. Exporters are waiting and looking for new customers."

Donald Trump’s first tenure was China’s tip to find buyers elsewhere. It expands links throughout Southeast Asia, Latin America and Africa – the belt, road trade and infrastructure program has established links with the so-called Global South.

China is reaping rewards from this diversity. According to the Loy Institute, there is more trade with the United States than China.

In 2001, only 30 countries chose Beijing as their main trading partner rather than Washington.

Geopolitical benefits

When Trump targets friends and enemies, some believe that Xi can further subvert the U.S.-led world order and portray his country as a stable, alternative global trading partner and leader.

After the tariff announcement, the Chinese leader chose to travel abroad for the first time in Southeast Asia, feeling that his neighbors would be upset about Trump's tariffs.

Now, about a quarter of China's exports are manufactured or shipped in the second country, including Vietnam and Cambodia.

Recently, the US actions may also give XI the opportunity to actively shape China's role in the world.

Professor Zhang said: "Trump's mandatory tariff policy is an opportunity for China's diplomacy."

Getty Images

Getty ImagesChina will have to act cautiously. Some countries will worry that products produced for the United States may eventually pour into their markets.

Trump's 2016 tariffs sent cheap imports originally used in the United States to Southeast Asia, harming many local manufacturers.

According to Professor Vaiya, "About 20% of China's exports are to the United States - if these exports flood any regional market or country, it can lead to dumping and vicious competition, which will trigger new trade frictions."

Getty Images

Getty ImagesXi Jinping has obstacles to using himself as an arbitrator of free trade in the world.

In recent years, China has imposed trade restrictions on other countries.

In 2020, after the Australian government called for a global investigation into the origins of the pandemic and early treatment of Beijing, Beijing saw it as a political move against them, China imposed tariffs on Australian wine and barley and adopted beef and wood on some beef, wood and bans on coal, cotton and custody. Australia's exports to certain commodities to China are almost the same.

Australian Defense Minister Richard Marles said earlier this month that his country will not "hold China" as the trade war between Washington and Beijing escalates.

China's past actions may hinder Xi Jinping's current global outreach activities, and many countries may be reluctant to choose between Beijing and Washington.

Getty Images

Getty ImagesEven with all kinds of difficulties, Xi Jinping bets that Beijing can withstand longer economic pain than Washington in this great power competition.

Last week, Trump seemed to blink first, suggesting a potential turnaround on tariffs, saying his taxes on Chinese imports so far have “a sharp drop, but not zero.”

Meanwhile, Chinese social media has started to take action again.

After the U.S. president softened his attitude toward tariffs, “Trump has been eliminated.”

Even if the conversation happens or when it happens, China is playing longer games.

The last trade war forced it to diversify from the United States to other markets, especially in the global south.

The trade war has allowed China to look in the mirror to see its flaws - whether they can be resolved will depend on the policies set by Beijing rather than Washington.

Top Image Source: Getty Images

BBC is the best analysis of homes and apps on the website, with new perspectives that challenge assumptions and in-depth coverage of the biggest issues of the day. We also showcase thought-provoking content from BBC Voice and iPlayer. You can send your feedback to our feedback by clicking the button below.