Thames water has been fined £122.7 million and has been told its "disappointed customer, failed to protect the environment" by Watt's water regulator.

The company has huge debts and is working to resolve leaks, stop sewage overflows and modernize outdated infrastructure.

It serves about a quarter of the UK’s population, mainly in parts of London and southern England, and has 8,000 employees.

Why is Thames fined?

Ofwat ordered Thames Water to pay a fine after two investigations into its business.

The company was fined £104.5 million for violating rules related to sewage treatment operations.

After heavy rain, water operators can release untreated waste into rivers and oceans to prevent house flooding.

But Ofwat's regulator said its findings suggest that storm overflows on the Thames three-quarters of the Thames are overflowing "regularly rather than in special cases."

In addition, Thames was fined £18.2 million for millions of dollars in payments to its shareholders in 2023 and 2024. Given the company's performance, Ofwat called these "inappropriate".

The money from Ofwat's fine will eventually be used for the Treasury Department, but no definite decision has been made on how it is used.

Thames estimates that the Thames could be fined up to £900 million over the next five years for leaks and sewage overflows, which will hinder efforts to attract new investments.

What are the regulators’ comments on Thames Water’s dividend?

The Ofwat fine marks the first time a water company faces a fine because it pays shareholders, which is called dividends.

The regulator highlighted the £37.5 million paid by Thames Water in October 2023 and £131.3 million in March 2024, saying it was "broken by the rules".

Regulators say shareholder spending “does not correctly reflect the company’s delivery performance.”

Thames River Water said the dividend “is declared as dividend after taking into account the company’s legal and regulatory obligations.”

How did the Thames finally get so much debt?

Many British water companies are in high debt, but the Thames water problem is the worst.

When the Thames was privatized in 1989, it had no debt. But over the years, it has borrowed heavily, with total debt (including all borrowings and liabilities) now at £22.8 billion Based on latest financial results.

When Australian Infrastructure Bank owned the Thames River water, it sold in 2017, debt rose sharply.

Macquarie said it invested billions of pounds while owning the company to upgrade the Thames water and sewage infrastructure, but critics say it costs billions of pounds of loans and dividends.

What does this mean for customers?

No matter who ends up owning or operating Thames Water, customers will not see the impact on their services. The faucet will still run and the toilet will still flush.

However, Thames has said it needs to increase bills to resolve the issue.His average annual bill rose almost a third to £639 in April.

Consumer groups believe that because the company is not operating well, people don’t have to pay more.

But Sir Adrian Montague, chairman of Thames Water, warned that without a larger price increase, the company could not guarantee a safe and resilient water supply that could cope with climate change and population growth.

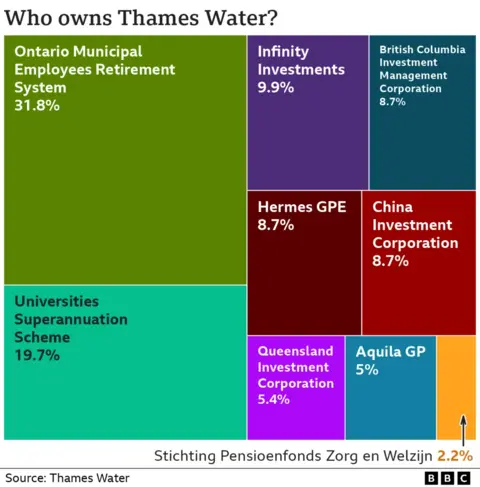

Who has the Thames water now?

The Thames River water is privately owned by a group of pension funds and investment companies. The largest shareholders include:

- Ontario Municipal Employee Retirement System (Canada) - 32%

- University Pension Scheme (UK) - 20%

- Abu Dhabi Investment Authority-10%

- China Investment Company - 9%

Other investors include funds from Canada, Australia and the Netherlands.

Can the Thames fall under government control?

Earlier this year, Thames received £3 billion in emergency funding, which it said would give it the space it needs to complete a debt restructuring and attract cash injections from potential new investors.

After a group of creditors objected to the proposal, the proposals had to be approved by the High Court, deeming the interest rate of 9.75% of the loan was too expensive.

The group then appealed the High Court's ruling, but this was dismissed.

If the funding agreement has not been approved, the Thames will face the possibility of temporary nationalization, a measure called the Special Administration.

Will the Thames River be purchased by American companies now?

Thames Water is discussing a cash injection of up to £5 billion with US investment group KKR.

KKR is one of the world's largest private equity firms with a global investment of $160 billion. The company is already a shareholder in Northumbria Water, another UK water provider.

The transactions completed also depend on the company's lender, which accepts the billions of dollars in discounts they owe. Some junior lenders can see their full loans being written off.

Thames said in March that no definite proposal would appear and any transaction would require regulatory approval.

Why is Thames privatized?

Under the conservative government of Margaret Thatcher, the entire water and waste sector was privatized. Thatcher wrote down the industry’s £5 billion debt, keeping the company’s debt clean and giving them £1.5 billion in public funds.

At that time, the UK was under pressure to meet European water quality standards. Thatcher hopes to need billions of pounds of investment to come from the private sector and expand the company’s customers.

Mrs. Thatcher said in 1988: "If we want to improve the environment, it will cost money. That will be the people who want improvement in the water."

But, critics say privatization does not take too much debt in water companies, but does not invest in infrastructure while taking too much debt.