It's not a boom, but it's worth a look.

Today’s economic figures may reflect unstable trade war factors and a stagnant rebound late last year.

If the gravity of rising U.S. tariffs and taxes do take a big hit, the growth could be short.

However, effective warnings should not hinder the main story here.

The UK economy is performing much better than forecasts in the first three months of this year.

It has almost no recession.

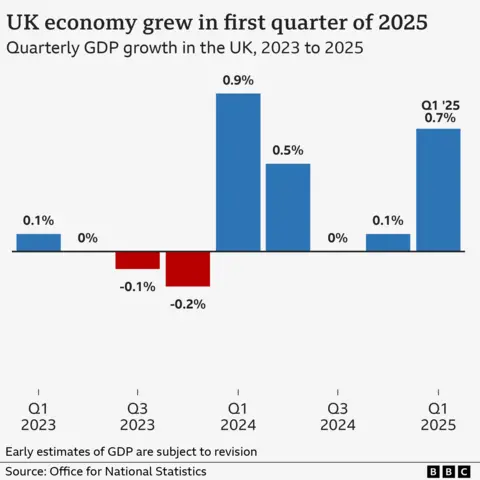

The growth rate is 0.7%.

At least in the quarter, this is a return on a normal, healthy level of growth.

About the successive government favorite indicator - the rest of the G7 developed economies - the UK will now be the fastest growth. The figures for Japan and Canada will be confirmed in the coming days, but they will be lower.

While almost everyone expects growth in the quarter, this figure should change the framework for thinking about the UK economy after months of tariff uncertainty and April tax increases.

Are millions of households still suffering from squeeze costs? Yes.

Are small businesses suffocating under the suffocating pressures of employer national insurance and national residence wages in terms of retail and hospitality? Too.

But staying away from those important sectors is certainly resilient and seems to be more than just.

The impact of lower interest rates and relative political and economic stability may be more important.

Real income has increased, and for many businesses outside of retail and hospitality, the rise in state insurance contributions is accommodated through tighter profit margins and wages.

Of course, the other side of the rise in national living wages is a stronger consumer, because the population does spend in stores.

Britain was a far cry from the forecast in early January when broad doom equated with rising government borrowing rates (mainly driven by global factors) rather than the risk of a specific UK mini-budget style crisis.

There are obvious challenges.

The shadow prime minister said there was no champagne cork, but when Rachel Reeves spoke at the Rolls-Royce factory after its publication, there was no bubble.

But this number provides the Prime Minister with an opportunity to follow the growth stuttering (partially self-caused) under this administration.

In the current global trade uproar, as an oasis of stable tariffs, economic growth, stable economic policies, falling interest rates and the position of gripping are selling points in an uncertain world.

That's why Reeves rejected my suggestion that her welfare cuts might be negotiable after the obvious backstage uprising: "We're going to take these reforms," she said.

But given the Prime Minister’s focus on immigration repression, the Prime Minister may do more work, making it a priority for the government to convince businesses.

Businesses will have some interesting conversations soon, such as construction companies aim to deliver 1.5 million homes, as well as planned new infrastructure, even for employee care homes only.

At present, the UK economy seems resilient and strong, which is a relief.

This may be temporary, but we should not assume it. These figures provide some optimism and hard-working opportunity for the rest of the UK to sell.