On January 5, 2025, at about 2:35 p.m., the first severe hail of the season dropped a quarter-sized hail in Chatham, Mississippi. No injuries were reported, but $10,000 in property damage was caused, according to the federal storm incident database.

How do we know the storm caused $10,000 damage? We don't.

The estimate is probably the best guess, and his main job is weather forecasting. However, these speculations, along with thousands of speculations like them, form the basis for publicly available bad weather costs.

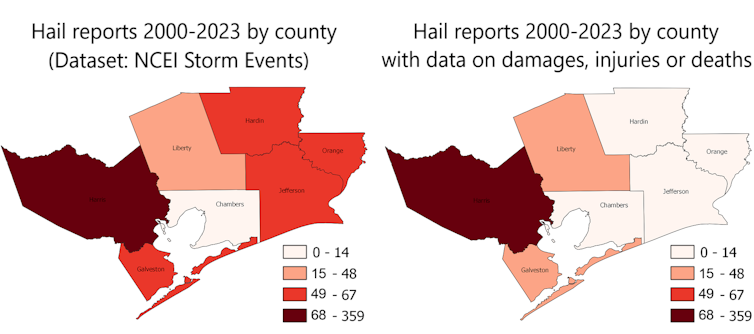

If hail in one county is estimated to be sustained lower damage than the next county, potential real estate buyers may think this is because of the less risk of hail. Instead, it may just be because different people are making estimates.

We are atmospheric scientists at Texas A&M University, responsible for the Texas Climatologist Office. By participating in state-level planning for weather-related disasters, over the past 20 years we have seen county-scale storm damage patterns that make no sense. So we decided to delve into it.

We studied storm activity reports in seven southeast Texas cities and rural counties with populations ranging from 50,000 to 5 million. We include all reported extreme weather types. We also spoke with people from two National Meteorological Services covering the region.

Storm damage investigations vary widely

Often, two specific types of extreme weather receive special attention.

After the tornado, the National Weather Service conducted a field injury investigation that examined its tracks and damage. The survey forms the basis for the official estimate of tornadoes on the enhanced range scale. Meteorological service staff can estimate good damage costs based on their knowledge of the value of houses in the area.

They also looked at flash flood losses in detail and could obtain loss information from the primary sources of household flood insurance in the United States.

If anything, most other losses from extreme weather are privately insured.

Insurance loss information is collected by reinsurance companies (companies that provide insurance companies) and provides lists for major events. Insurers use their own details to try to make better rate decisions than their competitors, so county event-based loss data is not readily available.

Lost a billion dollars in disaster data

Over the years, the United States has had a big window on how disaster damage changes

The National Oceanic and Atmospheric Administration (NOAA) edited information for major disasters, including state insured losses. Batch data won't tell communities or counties about their specific risks, but it allows NOAA to calculate the overall damage estimate, which has been released as its billion-dollar disaster list.

From this plan, we know that in recent years, the number and cost of a billion-dollar disaster in the United States has increased dramatically. News articles and even scientific papers often view climate change as the main culprit, but the bigger driver is the increasing number and value of buildings and other types of infrastructure, especially along the coast where hurricanes are prone to.

Critics over the past year have demanded more transparency and scrutiny of the procedures used to estimate the billion-dollar disaster. But that won't happen, as NOAA stopped conducting a billion-dollar disaster estimate in May 2025 and retired its user interface.

Previous estimates can still be retrieved from NOAA's online data archives, but by closing the program, the window to current and future disaster losses and insurance claims is now closed.

Emergency managers at the county level also made estimates of local losses, but the resources they provide vary widely. They can estimate damages only if the total may be large enough to trigger a disaster statement, which allows the federal government to provide relief funds.

A very rough estimate

If there is no insurance data or county estimate, the local office of the National Weather Service is estimated to have a loss.

There are no standard operating procedures that every office must follow. An office may choose not to provide any hail damage estimates at all, as staff do not see how accurate value is presented. Others may make estimates, but use different methods.

The result is a pieced together of damage estimates. For rare events, rare events that cause widespread damage are more likely to be accurate values. Loss estimates for more frequent events that never reach a high damage threshold are usually much less.

Do you want to see the local damage trends? forget it. For most extreme weather events, the estimation method varies over time and is not recorded.

Do you want to guide funds to help communities improve resilience in natural disasters that are most in need? forget it. Where the maximum per capita damage compensation depends not only on actual losses, but also on different practices of the local National Meteorological Service Office.

Have you moved to a location that may be vulnerable to extreme weather? Companies began to provide local risk estimates through real estate websites, but algorithms are often proprietary and have no independent verification.

4 Steps to Improve Disaster Data

We believe that some fixes can make the corresponding values in NOAA's Storm Events database and the larger Sheldus database managed by Arizona State University more reliable. Both databases include county-level disasters and loss estimates for some of them.

First, the National Weather Service can develop standard procedures for local offices that estimate disaster damage.

Second, additional national support can encourage local emergency management personnel to conduct specific damage estimates for individual activities and share them with the National Meteorological Administration. Local emergency managers are usually much better than forecasters sitting in offices in several counties.

Third, state or federal government and insurers may agree to disclose loss information at the county level, or other scales will not harm the privacy of their policyholders. If all companies provide this data, then there is no competition to do so.

Fourth, NOAA could create a small “tiger team” composed of damage experts to perform good, consistent damage estimates for larger events and train local offices to understand how to handle smaller things.

With these processes, the United States will no longer need a billion-dollar disaster plan. We will get reliable information about all disasters.