Technical Reporter

NatWest apologized after customers were unable to use their mobile banking app in the UK, thus preventing some from accessing their bank accounts.

More than 3,000 people have reported no-power outages to inspect on-site droppers since GMT first appeared in 0910.

The company said on its Service Status website that its online banking services are still operating properly - despite disputes among some customers. Payment will not be affected.

A NatWest spokesman told the BBC: "We know that customers had difficulty accessing the NATWest mobile banking app this morning."

“We are very sorry for this and try to solve it as soon as possible.”

BBC/NATWEST

BBC/NATWESTClients have entered social media to complain about the impact of IT failures on them.

One said they had to "replace my shopping back because of that" while another said they were "waiting to go shopping" but couldn't cash out the money.

NATWEST has advised clients on social media that its fixes “have no timetable” but says its team is “working” to resolve the issue.

Customers are advised to access their accounts in other ways, such as through online banking.

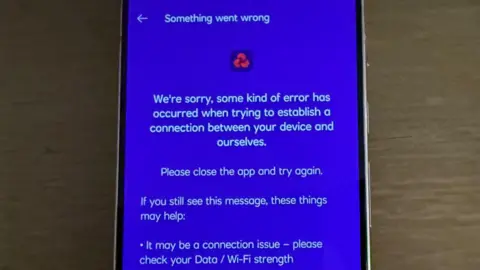

However, some people have also reported issues with NATWEST online services, one of which shares an error message that they say shows these errors when trying to pay.

Others expressed frustration at the bank’s response, one said it was “shameful” without a time frame, while another called it “very bad service.”

"What I didn't get is that banks closed a lot of branches to save money," said an angry client. "and forced people to rely on apps and online banking...but obviously didn't invest in a functioning system."

A recurring problem

This is the latest in a series of bank disruptions.

In May, many major banks revealed that 1.2 million people in the UK were affected by them in 2024.

According to a March report, there have been around 33 days in the technology disruption of nine major banks and construction societies since 2023, which is equivalent to 33 days.

For customers, inconvenience is also a price to pay for the bank.

The House of Commons Finance Committee found that Barclays could face £12.5 million in compensation payments since 2023.

During the same period, NATWEST paid £348,000, HSBC paid £232,697, and Lloyds paid £160,000.

Other banks have already paid smaller payments.