Getty Images

Getty ImagesBritish inflation unexpectedly fell in December, sparking expectations of a rate cut next month.

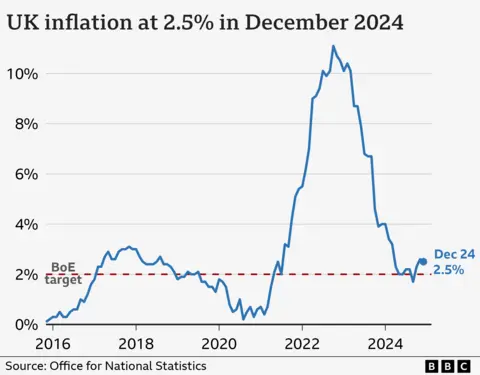

Prices rose 2.5% in the year to December, down from 2.6% last month and marking the first time inflation fell in three months.

The fall in prices was due to lower hotel prices and smaller than usual increases in airfares, but prices continued to rise faster than the Bank of England's target.

However, the latest data eased pressure on Chancellor Rachel Reeves, who faced criticism over the fall in the value of the pound and government borrowing costs hitting their highest levels in years.

Michael Saunders, a former member of the Bank of England's rate-setting Monetary Policy Committee, told the BBC: "If this continues, we will continue to cut interest rates even further."

The Bank of England decided last month to keep interest rates at 4.75% after policymakers said the UK economy was performing worse than expected. There was no growth at all between October and December.

But Ruth Gregory, deputy UK chief economist at Capital Economics, said the inflation data "strengthens the case" for a rate cut to 4.5% next month. Investors have also increased their bets on the possibility of interest rate cuts.

Inflation is well below its peak in October 2022 when prices soared, pushing up the cost of living for households and causing interest rates to rise, making loans, credit cards and mortgages more expensive.

Economists last month expected inflation to remain unchanged.

The Office for National Statistics (ONS) said slower rises in restaurant prices and falling hotel prices were helping to lower inflation.

Prices for tobacco products, including cigarettes, pouches, e-cigarette refills and cigars, are also rising at a slower pace.

But Grant Fitzner, chief economist at the ONS, said the impact was offset by higher costs for fuel and second-hand cars.

After the data was released, borrowing costs fell back to last week's levels and the pound edged up to $1.22.

Chancellor Reeves said there was "still work to be done to help families across the country meet the cost of living" but added that the government had "taken action to protect working class paychecks from the impact of higher taxes" and raised minimum wage.

But shadow chancellor Mel Stride said economic growth had been "stifled by this government" and called on Reeves to "urgently explain how she will now achieve this".

In response to market turmoil, Reeves is understood to be announcing Labour's industrial strategy.

Jane Sydenham, investment director at Rathbones Investment Management, told the BBC's Today program that investors needed to "know some of the details" of the UK plan.

"Are there going to be some tax breaks for certain industries? I think specific details and actions are what the market wants to see," she said.

Rising borrowing costs have a knock-on effect on the government's tax and spending plans, as the government will have to pay more interest to finance its existing debt. This leaves less spending on public services and investment.

Darren Jones, chief secretary to the Treasury, told the BBC the public service "has to live within its means".

Asked if it sounded like cuts were coming, he responded: "It's just a matter of priorities."

“You can only charge so much”

Jonny Gettings, operations director at Southampton Italian restaurant and small hotel Ennio's, told the BBC the outlook for the business comes as the minimum wage and National Insurance contributions increase and business rates relief is reduced from April. Seems "pretty bad".

Mr Gates added that cutting staff hours would be "a last resort" but said restaurants could consider reducing menu sizes, reviewing suppliers or changing opening hours.

"Once the prices go up, there's another bunch of issues to deal with because there's a concern that customers will vote with their feet and they'll go eat elsewhere," he added.

"You can only charge a certain amount for a menu item before the guest says, 'Okay, wait a minute.'"

Rents and bills rising

Some people have phone and broadband contracts linked to inflation, meaning their bills will rise in April based on the latest data.

Comparison website Uswitch said broadband bills increased by an average of £21.99 a year and mobile phone bills by an average of £15.90 a year.

However, due to new rulesMany contracts now show expected rises in pounds and pence each year during the agreement.

Separate data released by the Office for National Statistics on Wednesday showed average rental costs rose 9% in December from a year earlier, and UK house prices rose 3.3% in the 12 months to November, with Northern Ireland recording the largest increase.