U.S. economy signing rate is 0.3% as Trump tariffs prompt imports to surge

Free unlock edited abstracts

FT's editor Roula Khalaf chose her favorite stories in this weekly newsletter.

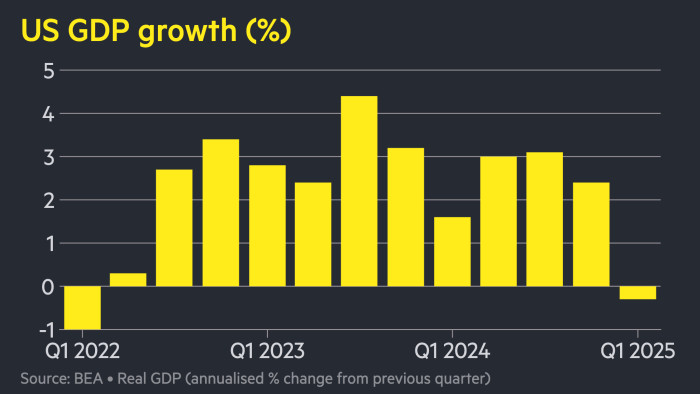

The U.S. economy signed an annualized 0.3% in the first quarter, with companies in the world's largest economy responding to Donald Trump's trade war by rushing to import goods.

The decline in GDP readings (for the first time since 2022) is worse than the latest forecasts by economists and is compared with a 2.4% increase recorded in the fourth quarter.

This is largely the result of U.S. companies’ rush to buy goods from abroad before Trump was widely subject to tariffs, with imports growing at a 41% rate.

But many analysts believe that the title GDP figure is mainly due to the recent increase in trade deficits rather than reflecting the underlying trend.

The calculations used for Wednesday's figures are achieved by subtracting imports (including domestic consumption, investment and exports) from total expenditures.

Economists at Morgan Stanley said the surge in imports ultimately led to inventory, consumption and investment – positive factors that calculate GDP, which are not fully reflected in Wednesday's data.

“In fact, imported goods are not fully present in the expenditure part of the GDP account, thus exaggerating GDP weaknesses,” they said.

Instead, some economists focus on other measures, such as investment and consumer spending.

Total consumer spending and private fixed investment in the first quarter rose 3% to 2.9%, data on Wednesday showed.

In an article on his Truth Social Network, Trump suggested that the numbers “have nothing to do with tariffs.”

Blaming former President Joe Biden, who added: “I won’t take over until January 20… when the boom begins, and this will not be anything else.

Acknowledging inventory that occurred before Trump’s tariff announcement this month, the Bureau of Economic Analysis generated Wednesday’s data highlighting the rise in “private inventory investment.”

Without this contribution, GDP figures will shrink at an annualized annualized 2.5%.

To further demonstrate the scale of the business’s import efforts ahead of tariffs, the U.S. commodity trade deficit hit a record $16.2 billion in March in figures released this week.

Economists expect imports to fall in the second quarter, with foreign goods previously stored being purchased by U.S. consumers.

Chief economist Gregory Daco, chief economist at Ey-Parthenon, said the company “has a huge shock to GDP.”

But he called the factors behind Wednesday's GDP figures “an unprecedented distortion” that are unlikely to change the Fed's calculations of the basic performance of the U.S. economy.

Although the commodity trade deficit delayed the total GDP figure for the quarter, this part was offset by corporate spending on storage.

Stock futures fell, bond yields rose slightly. The two-year fiscal yield, which moved upward with interest rate expectations, rose 0.01 percentage point to 3.66%.

Expectations for lower interest rates after the data have not shifted significantly, while futures market traders are still cutting about four cuts this year.

The Economic Analysis Bureau said the decline in output in the first quarter also reflected a decline in government spending.

It added that consumer spending is also one of the factors that partially but not entirely offset the decline in imports and government spending.

“The strong domestic demand figures are a shocking reminder of what might be an elegant soft landing until the full tariffs deviate the economic scope from the curriculum,” said Cornell professor Eswar Prasad.

Trump's trade war is expected to lead to slower growth and higher prices in the second half of this year.

The International Monetary Fund said last week that U.S. GDP will grow 1.8% this year, which is from its January estimate of 2.7%. Many private sector forecasters have no growth at all.

Other reports by Kate Duguid in New York