U.S. economy shrinks as businesses import more before tariffs

BBC News Business Reporter

Getty Images

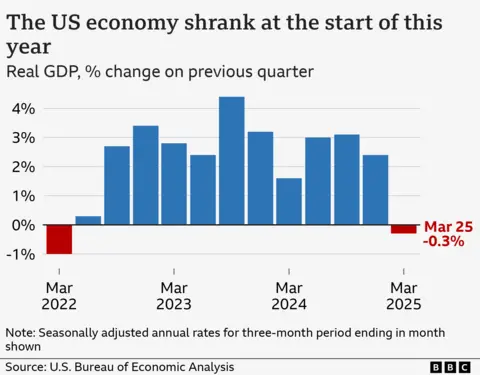

Getty ImagesThe U.S. economy shrank in the first three months of the year as government spending fell and import companies soared due to corporate competition to bring goods before tariffs.

The Ministry of Commerce said the economy fell sharply after 2.4% growth in the last quarter.

These figures mark a first quarter decline in three years and are due to the introduction of import taxes by President Donald Trump, which speculated on global trade and created significant uncertainty.

But analysts say it will take more time to understand the impact of tariff changes.

Although imports oppose growth in gross domestic product (GDP) calculations, it is expected to reverse and emerge in the coming months. These swings do not necessarily indicate poor economic performance.

The report also showed that consumer spending, the main driver of the U.S. economy, grew 1.8%, although slower than in 2024.

In a television appearance with cabinet members, Trump accused his predecessor, Joe Biden, of weakening economics, believing his policies would drive investment in the U.S. and economic prosperity.

“It's Biden,” he said, seemingly avoiding price increases, supply shocks and shortages of items such as toys, such as sharp declines in trade between the United States and China.

“Well, maybe the kids have to have two dolls, not 30 dolls, you know? Maybe these two dolls cost a few dollars more than usual.”

The White House said in a statement that GDP figures are a “backward indicator.”

“The basic numbers tell the true story of President Trump's realization of strong momentum,” said press secretary Karoline Leavitt.

Since reentering the White House in January, Trump has swept the business world, announcing a series of new trade tariffs that he said would raise funds for the government and help boost U.S. manufacturing.

Analysts say that while he has downplayed some policies, analysts say the measures have still made the U.S. overall effective average tariff rate the highest for more than 100 years.

The report tracks activity throughout the end of March, a time when Trump announced his most profound “liberation day” tariffs on China and the rest of the world This caused a huge sell-off in the stock market, and turbulence in the currency and debt markets caused a huge sell-off.

It shows imports soared more than 40% in the first three months of the year, while consumer spending rose 1.8%, down from 4% at the end of 2024.

Analysts warn that the numbers could move forward with expected tariffs to buy people who may be distorted.

The report also showed unexpected growth in commercial investment, while final sales for private domestic buyers (close attention indicators of overall demand) rose by 3%, with little change from the previous quarter.

“Overall, it’s not as bad as fear,” said Paul Ashworth, chief economist at capital economics.

Tariffs are taxes on imports, and economists warn that this will lead to higher prices.

Some companies, such as tool maker Stanley Black & Decker, have announced plans on Wednesday to raise prices in response.

Growth may be further weakened if shoppers decline as expected at higher prices and demand.

When U.S. companies enter busy investors publicly updates, many companies, including Stellantis and Mercedes, said they could not guide sales expectations in the coming months with uncertainty.

The leading U.S. stock index recovered from huge losses when Trump rolled back some plans.

But Wells Fargo economists say it's hard to draw a firm conclusion from the latest data, noting that dragging growth from trade is the largest since the 1940s.

“Today, the risk of a recession in the U.S. economy is greater than a month ago, but this contraction in GDP is not the beginning,” they said.

Other reports by Bernd Debusmann Jr at the White House