(Bloomberg) — The U.S. economy maintained a comfortable cruising speed into the final stretch of 2024, supported by healthy consumer spending and creating more separation from its global peers.

Economists surveyed by Bloomberg Projects gave the government's initial estimate of fourth-quarter gross domestic product (the sum of goods and services produced) to show an annualized 2.7% increase. This would follow back-to-back quarters of roughly 3% growth.

Thursday's report on U.S. economic activity comes a day after the first Federal Reserve policy meeting of 2025. Officials are widely expected to keep borrowing costs steady against a backdrop of healthy demand and stubborn inflation. Policymakers said at Confab in December that they had signaled only two interest rate cuts this year.

GDP data are expected to show personal consumption of goods and services exceeded 3% for the second consecutive quarter amid a strong labor market. This helps explain how the United States continues to outpace advanced economies in Europe and around the world.

In contrast to the United States, next week's figures are expected to show the French economy stalled in the end months of 2024, with a slight contraction in Germany. GDP data for the wider euro zone (also due to be released on Thursday) was found to show less growth – extending a multi-year trend of sluggishness.

Friday's U.S. household spending numbers could point to momentum going into 2025. Economists also expected personal income and spending reports to show a slight increase in the Fed's preferred inflation gauge from a month ago.

“While loan borrowing rates have been rising, especially for lower-income households, wealthy households, which account for about 40% of consumer spending, have benefited from stock market rallies and asset appreciation. We include this signal in our 2025 consumption forecast Once on board, spending is now expected to gradually slow down compared to before.”

– Anna Wong, Stuart Paul, Eliza Winger, Estelle OU and Chris G. Collins, economists. For the full analysis, click here

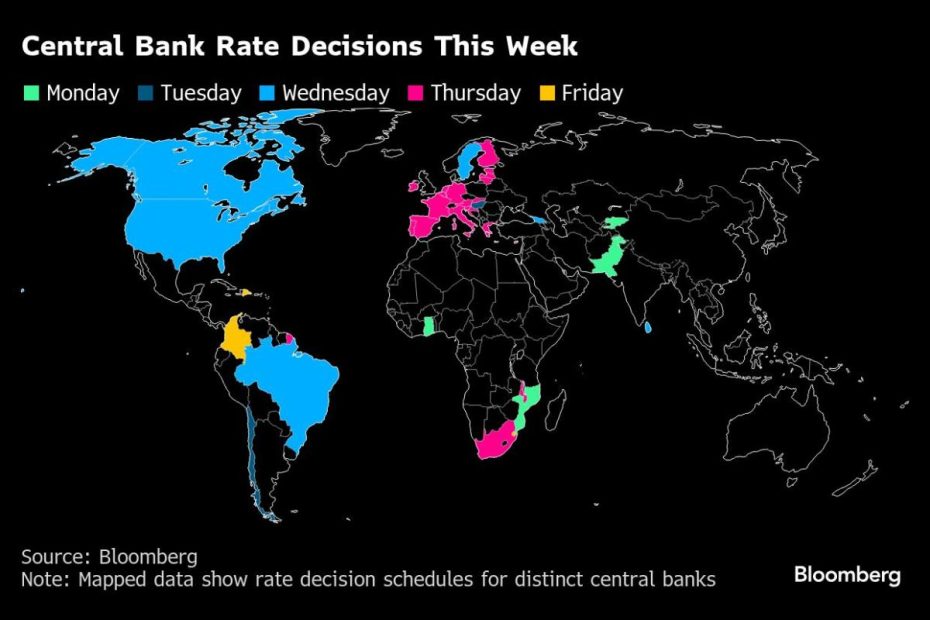

Looking north, the Bank of Canada is expected to cut interest rates by 25 basis points on Wednesday, a slowdown after two consecutive 50-basis point cuts by U.S. President Donald Trump. Donald Trump's tariff threats have caused considerable uncertainty.

GDP data for November and flash estimates for December will show the impact of the US election and the impact of Prime Minister Justin Trudeau's business tax holiday on the economy.

Elsewhere, lower rates in the euro zone and Sweden were among the expected bright spots. Several reports from Japan and an important speech by the British Prime Minister will also keep investors occupied.

Click here to catch up on what's happened over the past week, and here's our package of what's happening in the global economy.

Asia

It's been a relatively quiet week in Asia, with much of the region including China, Hong Kong and South Korea celebrating the Lunar New Year starting on Wednesday.

China on Monday released manufacturing data for January as well as industrial profits for December, which will mark another month of declines.

Japan was the quiet exception after the central bank decided on Friday to raise tax rates at the fastest pace in 17 years. The data deluge begins on Tuesday, with producer prices among service companies expected to show another pickup in December. Consumer confidence was reported the next day.

Friday took a look at the rest of the Japanese economy: Unemployment is likely to remain stable in December, while consumer prices in Tokyo, the largest city and country proxy, are likely to rise slightly in January. At the same time, retail sales are expected to show little change in December compared with the previous month, and housing starts may decline at a faster rate. Preliminary industrial production numbers for December will also be reported.

Australia releases several indicators, including consumer prices for December, which will be available from the previous year. Import and export prices for the fourth quarter were reported on Thursday, with producer prices for the final three months of 2024 also on Friday.

On Thursday and Friday, New Zealand releases trade data as well as consumer and business confidence.

In the Philippines, numbers on Thursday will show GDP expanded faster in the fourth quarter than in the previous three months. Thailand capped the week on Friday with trade and manufacturing production numbers.

Elsewhere in Asia, Pakistan's central bank is expected to cut interest rates on Monday and Sri Lankan officials announced their policy rate on Wednesday.

Europe, Middle East, Africa

A 25 basis point rate cut from the European Central Bank was all but confirmed at the Governing Council's first decision of the year on Thursday.

Further reductions are likely as policymakers fret about Trump's possible tariffs and his relatively persistent stance on inflation risks. Following the announcement, investors will look for clues in President Christine Lagarde's comments to reporters.

In addition to the closely watched German IFO business sentiment report on Monday, fourth-quarter GDP data is also due hours before the ECB results.

They are likely to reveal contraction in Germany, stagnation in France and paltry expansion in Italy holding back the wider region, which is expected to add just 0.1% to overall growth.

Officials were also told there would be a reading on Spanish inflation, which is expected to be unchanged at 2.8% in January. Other such reports will arrive on Friday, with Germany likely to be stuck at 2.8% and France seeing a slight acceleration to 1.9%. Eurozone numbers are due next week.

In the UK, investors are likely to focus on Prime Minister Rachel Reeves' main speech on Wednesday, following a turbulent start in financial markets and an avalanche of bad economic news. Bank of England governor Andrew Bailey and his colleagues will testify on financial stability matters on Wednesday.

Read next: More job cuts loom after UK firms fall under Covid cover

Elsewhere in the wider region, South Africa and Nigeria are to release details on overhauls of their inflation data. Both will change their reference year to 2024 and reweight some indexes. Nigeria will also rebound its GDP figures.

Some monetary decisions are scheduled:

In Mozambique on Monday, policymakers kept their key interest rate at 12.75% to control inflation, which accelerated to 11 months and is expected to rise further due to election-related unrest.

Ghana is expected to keep borrowing costs unchanged on the same day as officials try to curb inflation, which averaged 23% last year and is only expected to return to the central bank's 6% to 10% target band in the fourth quarter.

Back in Europe, Hungarian policymakers on Tuesday prepared to keep their ratio at a European Union-high 6.5% following high consumer prices.

Sweden's Riksbank is likely to cut a quarter point to 2.25% on Wednesday, the sixth move in its easing campaign, after most policymakers recently raised the stakes after inflation slowed. Most policymakers took this action.

The next day in South Africa, officials were also able to cut interest rates for the third consecutive quarter-point, to 7.5%. They see inflation remaining below the 4.5% midpoint of the target range until at least mid-2025.

Latin America

Chile's central bank meets on Tuesday after easing policy in 11 of its past 12 meetings. The economy has been losing momentum, but headline inflation is actually rising in 2024, amid pressure on energy prices and weakness in the peso, which analysts predict holds 5%.

Colombia's central bank is more likely to lower its tax rate for the 10th consecutive meeting, to 9.25%. Policymakers slowed their pace of easing in December as Brazil's fiscal imbalances jolted markets across the region.

A deterioration in inflation expectations thereafter could give policymakers reason to pause.

Mexico releases full 2024 trade results and December unemployment rate ahead of fourth-quarter output. Analysts marked their October-December estimates, with some seeing a negative print versus the previous three months.

Brazil presented reports on its loans and government budget balances, as well as the broadest inflation readings, while the country's central bank released a survey of expectations.

Banco Central Do Brasil also held its first monetary policy meeting of the year and promised its second consecutive hit by raising the tax rate to 13.25%. Inflation is increasingly above the 3% target, and expectations are unchecked.

– With assistance from Laura Dhillon Kane, Katia Dmitrieva, Monique Vanek, Robert Jameson, Ott Ummelas and Alexander Weber.

Most from Bloomberg Businessweek

©2025 Bloomberg LP