This leading artificial intelligence (AI) stock is now cheap

Artificial Intelligence (AI) investment continues to be at the forefront of most investors' thoughts. This technology requires a lot, and we have almost no surface.

The currently cheap AI stock is letter (Nasdaq: Goog) (Nasdaq: Googl)This is one of the best stocks I bought now. Even what happened in the AI model using DeepSeek's R1, I still think that Alphabet is an attractive purchase.

Alphabet is the parent company of Google, so it is not necessary to win the generated AI military reserve competition. This is important, because the generation AI platform Gemini is usually listed at the top of the best AI model, although it is not the first choice.

Although Alphabet hopes to use Gemini as the highest AI platform, it does not need it. The main business of Alphabet is advertising, and 75 % of its revenue comes from advertising sources in the third quarter. Although Alphabet spends time to develop the Gemini model, it can be constructed by developers (they own), the real advantage of its model has always been the integration of it with various advertising services.

Integrate Gemini to Google Advertising, users can develop advertising activities faster to adapt to individual consumers. This keeps Google at the top of the advertising game and ensures that customers will continue to come to them to get a lot of benefits.

Alphabet also has Google Cloud, its cloud computing department. Together with the AI workload, many non -AI workloads have been built on Google Cloud. Cloud computing will continue to be a huge exercise because the company needs to access computing power to build its AI model and workload.

Although customers can use Gemini or Deepseek R1 as the basic language for building a platform, they still need cloud computing providers to continuously run their computing power. As a result, the cloud computing section of the alphabet is still used to a stronger growth.

Therefore, even if the R1 model of Deepseek is released, the letters are still in a strong position and can benefit from the AI military reserve competition. Fortunately, it is also sold.

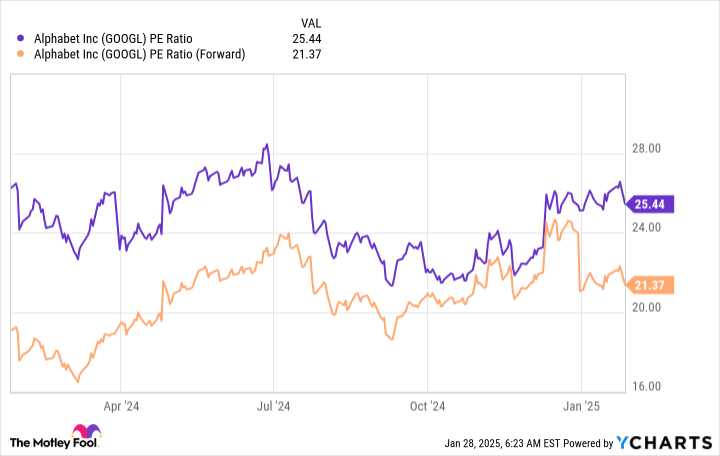

Like some large technologies traveling, Alphabet has never obtained advanced valuations. At present, Alphabet's stock transaction is 25 times and the yield rate is 21 times.

and S & P 500The yield of transaction is 26 times, while the long -term returns are 22 times, and the letters are traded with slight discounts. Although the letters have strong growth numbers, this still exists.