The couple balances 15 credit cards without debt, saving nearly $ 500,000

15 juggling cards may sound too much, but Air Force officials Quinn and Brittney Sturgis use them to make strategies to make money and establish credit amounts. This is only one of the habits of strict discipline. These Habits help them save nearly $ 500,000 in their 20s.

“We will never be balanced.” “We will never balance.” “Whether in the previous billing period, the balance of payment will be automatically paid before the next billing cycle.”

By doing so, they avoid interest costs while making full use of the interests of the card, including earning cash return rewards on flights or hotels, aviation mileage and upgrades.

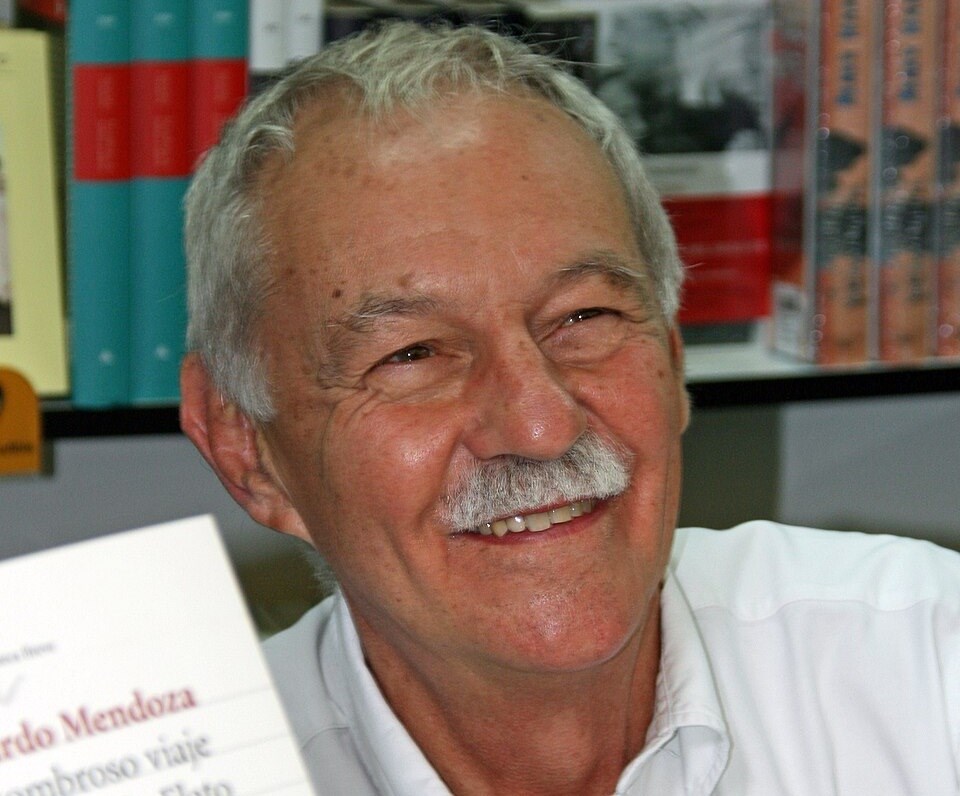

The Stergis family.

Provided by Quinn and Britney Stggel

The couple-all stationed at the Tel Avis Air Force Base in California, mainly using a small amount of cards for daily purchases, such as their chasing freedom or American courier gold card. The less frequency of the couple is to use the Costco card for gasoline and Hilton Honorary ASPIRE Card for hotel reservation.

As a member of the active military service, they also benefit from the annual expenses of the high -end card, reducing costs and easier to get the maximum rewards.

In addition to cash rewards, travel allowances usually pay huge fees. “We have conducted many family travel paid by points.” Including business class flights from San Francisco to London recently, it is completely covered by airline points.

These benefits help them expand their budgets. They invested about 30 % of their income.

Their credit card strategy is “not suitable for everyone”

Tennessee's certified financial planner Betsy Hutchins said the ability of the couple to manage so many credit cards is impressive. She said: “I have extended their advantages to maximize their ability to maximize their ability to maximize their advantages.” “” He pays their honor to them every month. “

Although holding balance can lead to high interest -interest debt (especially interest rates of more than 20 %), credit cards have advantages than debit cards. These include more powerful protection measures, such as zero responsibility for fraud and easier allegations to make it a wise choice for daily expenditure. The larger credit limit can also help improve your credit score.

In other words, Noah Damsky, Los Angeles, said that he carried 15 “not suitable for everyone.”

He said that although Quinn and Brittney effectively improved financial awards to the greatest extent, from a practical point of view, “squeezing the last few credit card points” may not be the best because management and management and management and management and The pain of tracking is so painful. “

Brittney and Quinn Sturgis wear uniforms.

Kevin Heinz | CNBC did so

Management of 15 credit cards (Quinn) is called “amateur hobbies”) requires important organizations and financial discipline, not everyone is working hard.

Harchins said that although the Stggel family “sounds incredible discipline in the way of using consumer credit”, “a large amount of willpower and records need to be kept to maintain 15 credit cards without. Continuous balance.

For most people, she recommends carrying no more than four credit cards. Otherwise, for typical borrowers, it will become “furry”.

However, “Obviously, Stergis is not typical, which is useful for them.”

Want to improve your AI skills and improve productivity? Participate in the new online course of CNBC How to use AI more successful at workEssence Expert coaches will teach you how to get started, actual use, effective timely writing skills, and avoiding errors. Register and use the coupon code early to enjoy the early bird to enjoy a 30 % discount of $ 67 (+tax and expenses) By February 11, 2025.

add, Register CNBC MAWE MADE communication In order to succeed, the success skills and tricks of money and life.