Stocks on edge to erase Trump gains as interest rate worries set in

(Bloomberg) — It’s the round-trip ticket no one on Wall Street wants.

Most read from Bloomberg

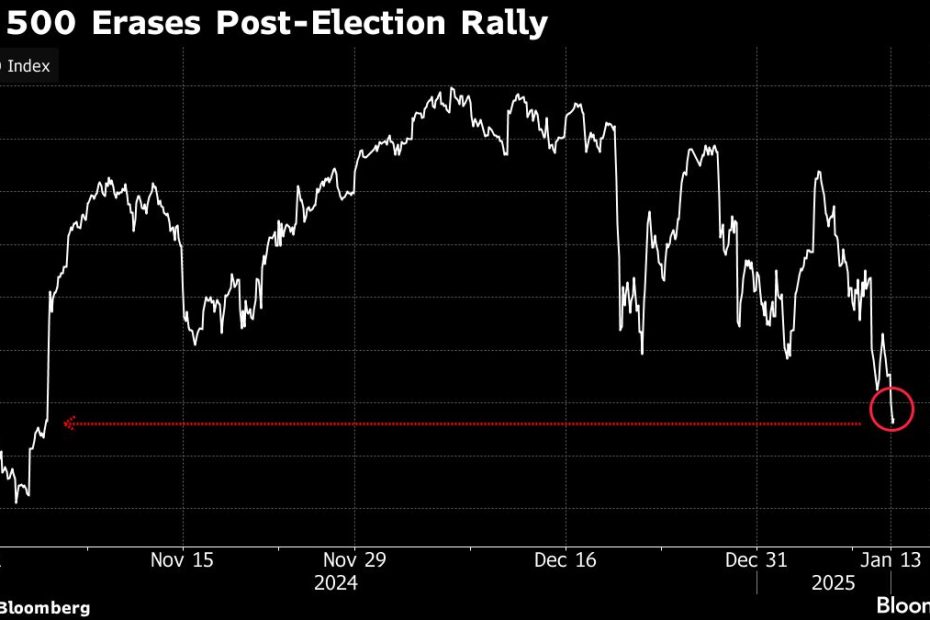

The S&P 500 briefly fell below its closing price on November 5, before Donald Trump was elected president, before closing just above that level on Monday. Investors are selling stocks and interest rates are climbing amid growing concerns that the Federal Reserve will have to scale back its plan to cut interest rates this year to combat inflation as it remains stubborn. Friday's unexpectedly strong jobs data only heightened those concerns.

Earlier in the session, the stock market benchmark fell to a low of 5,773.31 points but recovered losses to close slightly higher at 5,836.22 points. Ahead of Election Day vote counting, the S&P 500 closed at 5,782.76. The index rose 2.5% on Nov. 6, its best post-Election Day performance ever, after Trump was declared the winner. It continued to climb over the next month, eventually rising 5.3% from November 5 to a peak on December 6. It is down more than 4% from its all-time high.

There are several reasons for the decline: a deteriorating economic outlook; growing concerns among investors about high stock valuations; and growing concerns about the Fed's path to cutting interest rates. Traders have also been assessing the potential impact of Trump's proposed policies, which include sweeping tariffs on imported goods and mass deportations of low-wage undocumented workers.

That concern is already showing up in the bond market, with 20-year Treasury yields above 5% and 30-year Treasury yields surpassing that milestone on Friday before falling just below that level. Now, the policy-sensitive 10-year Treasury yield is moving in that direction, hitting its highest level since late 2023.

Stock market volatility is also on the rise, with the CBOE Volatility Index (VIX) hovering around 20, a level that typically signals anxiety among traders.

“This is a case of high expectations meeting reality,” said Michael O'Rourke, chief market strategist at JonesTrading, noting that translating campaign promises into policy is an arduous process.

There is growing recognition that tariffs will be a cornerstone policy of the new administration, but investors generally dislike this because tariffs tend to be a drag on economic growth. “The honeymoon may be over,” O'Rourke added.

different markets

One thing is clear, the stock market is very different when Trump is in the White House than it was in 2017. First, valuations had barely risen at the time but are now at precarious levels. The S&P 500 has risen more than 50% since the end of 2022, following two consecutive years of gains of more than 20%. In 2024 alone, it set more than 50 records. Compared with Trump's first term, when the S&P 500 rose 9.5% in 2016, it has risen just 8.5% over the past two years.