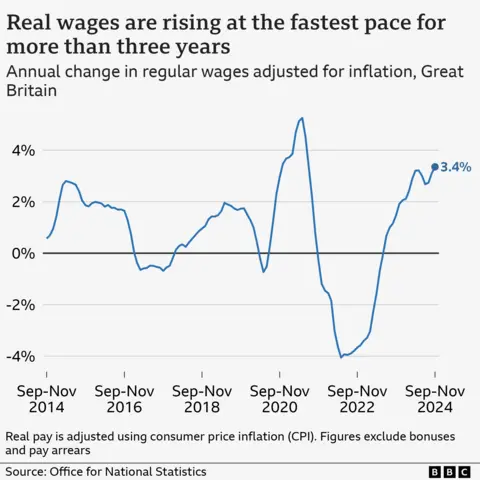

Post-inflation wage growth is fastest since 2021

Getty Images

Getty ImagesWages in the UK rose at the fastest pace in more than three years after inflation, driven by strong growth in private sector wages.

Figures from the Office for National Statistics (ONS) show that taking into account the impact of rising prices, wages increased by an average of 3.4% between September and November compared with the same period last year.

Growth in private sector income has been stronger than in public sector jobs.

The Bank of England is still expected to cut interest rates next month despite the risk of higher wages pushing up inflation.

Rates currently stand at 4.75%, but traders are betting rates will be cut to 4.5% in February after inflation, a measure of interest rate price increases, unexpectedly fell last month.

The Bank of England pays close attention to wage and employment data when making interest rate decisions. The latest figures from the Office for National Statistics estimate that average weekly earnings in the UK reached £660 in November, when inflation was 2.6%, compared with the latest figure of 2.5%.

“For about three and a half years, compensation hasn't separated itself from inflation in such clear blue water, so the difference is noticeable. It leaves us with more money at the end of the month,” personal director Sarah Sarah Coles said. Finance Department of Hargreaves Lansdown.

Ms Coles warned that rising wages could lead to higher inflation and a delay in interest rate cuts, but added that “overall, the lack of growth in the economy and one month of falling inflation may mean that rate cuts may be delayed”. February is still possible”.

Ashley Webb, an economist at Capital Economics, added that some policymakers at the central bank “may be concerned about the recovery in private sector wage growth” but said she doubted most of them It will “watch for signs of loosening in the labor market.” ” and cut interest rates.

From October to December, the UK unemployment rate is estimated to have risen to 4.4%, while the number of job vacancies is estimated to have fallen by 2.9% to 812,000, continuing to decline but still above pre-pandemic levels.

The Office for National Statistics has advised “caution” on its job market data, as low survey response rates raise questions about the data's relevance.

Petra Tagg, director at recruitment firm Manpower UK, told the BBC's Today program that organizations have been looking for staff with specific skills for engineering, IT and artificial intelligence jobs. “Offer high salaries.”

But she said workers were “less likely to move (companies) because people are more nervous about finding work in these… quite worrying times”.

Economists at Pantheon Macroeconomics said employment fell in December as “businesses paused hiring” following a tax increase on businesses announced in the budget.

Chancellor Rachel Reeves, under pressure as figures show the UK economy is stalling, decided businesses should bear the brunt of £40bn worth of tax rises, higher national insurance rates and employer cuts threshold.

Businesses have repeatedly warned that the additional costs, coupled with a rise in the minimum wage and reduced corporate tax breaks, could impact the economy's ability to grow, with employers expecting less cash to spend on pay rises and new jobs.

But Rob Wood, chief UK economist at Pantheon, added: “There are few signs of a sharp decline in the labor market, both in terms of jobless claims and layoffs. The labor market is easing, but only gradually.”

Ms Coles said the “good news on wages” may not last long this year because of the “risk” that businesses facing rising costs “will cut staff and see wages rise”.

In recent years, various industries in the UK have experienced worker shortages. That could be a drag on economic growth, but it could also lead to higher pay for workers in these industries as employers try to attract them, or current bosses try to retain them.

But when people have more disposable income, leading to more consumer spending, inflation ensues, pushing up demand for goods and causing prices to rise in stores.

Compared with the same period last year, normal wages increased by an annual average of 5.6% between September and November, but taking inflation into account, the actual wage increase was 3.4%.

The Resolution Foundation think tank said workers in 2024 “enjoyed the best year for wage growth since 2005”.

Work and Pensions Secretary Liz Kendall said there was “more evidence” from job market and wage data that the UK must boost employment.

She added that the government was “working hard to improve living standards and boost economic growth” while reforming job centers and “making sure every young person has the opportunity to earn or study”.