Kailin beats the fourth quarter forecast slightly, but sells 24% in the embattled Gucci brand

A Gucci store operated by Kering SA on Saturday, October 12, 2024 in the Sanlitun area of Beijing, China.

Bloomberg|Bloomberg|Getty Images

French luxury goods company dry On Tuesday, a year-on-year decline exceeded expectations for fourth-quarter sales as demand for its major Gucci tags lagged.

Brands of the high-end fashion group also include Bottega Veneta, Balenciaga and Alexander McQueen, with revenues down 12% in the fourth quarter to 4.39 billion euros ($4.52 billion), slightly higher than the 4.29 billion euros LSEGASTS forecast. .

Gucci's sales accounted for almost half of the group's total revenue, falling to 24% per year in three months to €1.92 billion, expanding losses to the group's once beloved luxury record company in a considerable way.

Full-year sales also fell 12% to 17.19 billion euros, while the expected 17.09 billion euros also fell.

Operating revenue for the year totaled €2.55 billion, in line with the group's revised forecast for October, but nearly half of the 4.75 billion shares achieved in the previous year.

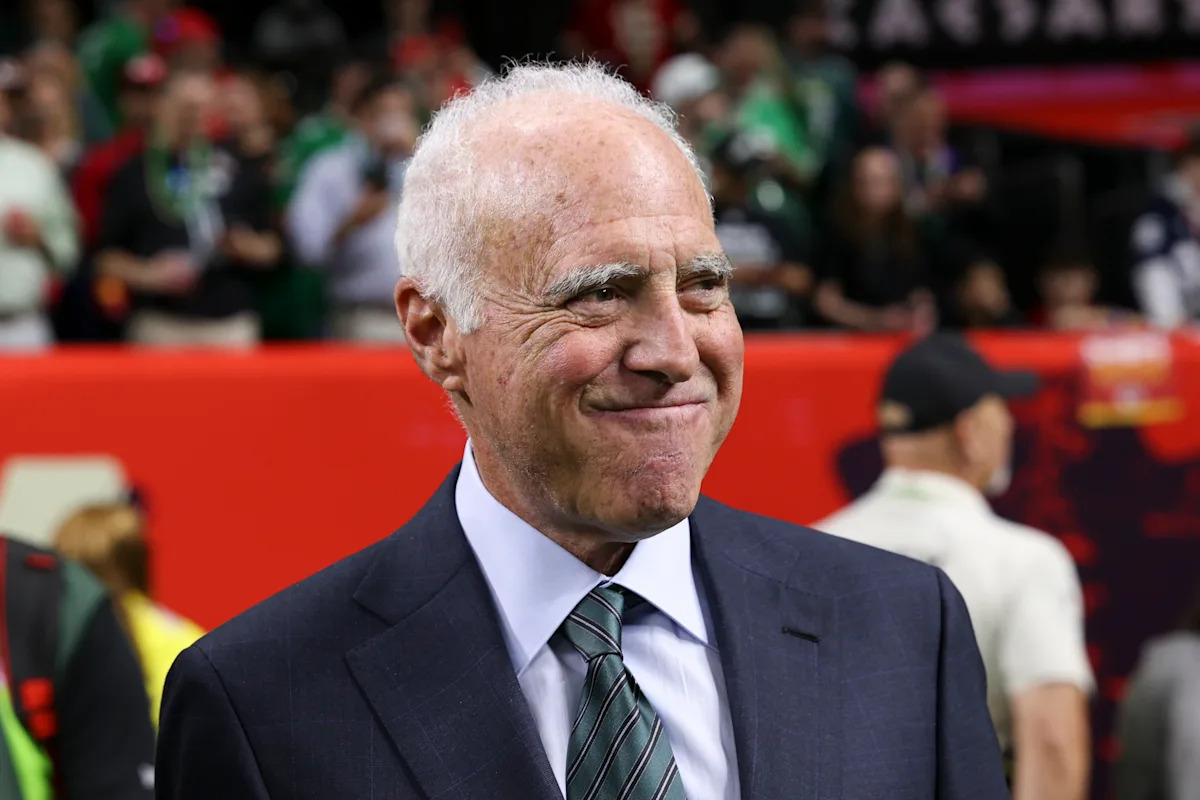

“In a difficult year, we accelerated the transformation of several homes and took a firm step forward,” François-Henri Pinault, chairman and CEO, said in a statement. To strengthen the health and expectations of our brand in the long term.”

“Our efforts must be sustained and we believe we have driven Killing to stabilize and we will gradually return to our growth trajectory.”

The French fashion house noted that sales of Gucci, Yves Saint Laurent and Bottega Veneta brands sold in Asia Pacific and North America have improved slightly, but did not provide detailed information on specific markets.

Tuesday, October 22, 2024, Gucci luxury boutique in Paris, France.

Bloomberg | Getty Images

Kering is the latest European luxury group to report earnings in recent weeks as investors look for signs of a resurgence in the industry hampered by a sluggish consumer spending, especially in major Chinese markets.

Last month, investors overwhelmed the full-year results that surpassed expectations only by luxury leader LVMH. The market is confident about the turnaround throughout the field following the outstanding results of Cartier boss Richemont, but continues to weaken the fashion, leather goods, wine and spirits segments of LVMH pointing to further divergence in the industry.

Kering, particularly exposed to Chinese consumers, has been battling a special downturn as its star record label Gucci is separated from Vogue.

On Thursday, the fashion group announced the departure of Gucci design head Sabato de Sarno, the first major change since Gucci CEO Stefano Cantino joined the brand last year. Minimalist designer De Sarno, after replacing Alessandro Michele, has defined the brand in the past few years.

The company said in a statement that the replacement for De Sarno will announce “in due time”.

Simone Ragazzi, senior equity analyst at Algebris Investments, said on Monday that Kering hopes to reset the brand with a new design appointment, but added that investors may remain cautious as legacy issues remain.

“It hopes the market bets for a long time. It's always a little question mark,” he told CNBC in a video call.

“In the past, the brand has been used to the ups and downs because it is one of the most fashion-driven luxury groups,” he continued. “Hopefully new designers can lower the brand.”