Ge Vernova's stock fell 20 % on Monday. That's why we sold the day before.

On Monday, as China ’s assumptions of the artificial intelligence pattern changed their assumptions, growth investors were rolling up. Generally, you may think that alternative energy companies like Ge Vernova will be affected by technology. But many power companies are regarded as “adjacent to AI” drama. The expected power requirements of AI computing power, data centers and all infrastructure means that even slow public business exceeds many growth names.

↑

X

DeepSeek water sink market, so why do we invest a lot of investment?

Strict action setting Ge Vernova entry

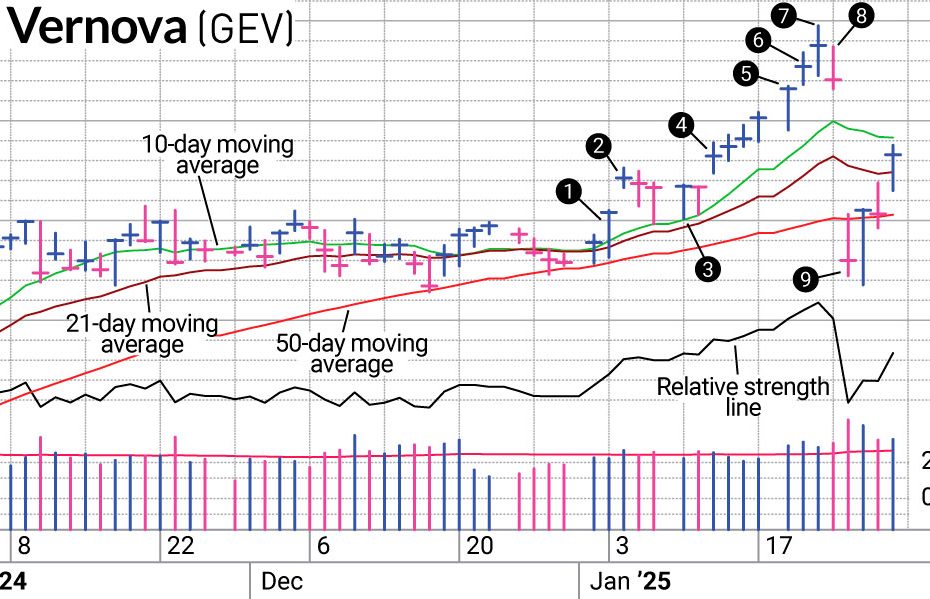

We are already familiar with Ge Vernova's personality, because we have multiple transactions the theme of the previous column. However, due to the breakdown of the resistance, the depth of this flat base settings only attracted us again. Gev joined Swingtrader, becoming one of our first batch of transactions this year (1)Essence From a complete position, the purpose is to quickly limit it to locking some profits.

The next day, we got this opportunity, which is a gap, which allows us to get 7 % of the profit from the participating works (2)Essence A quarter of decoration enables us to lock up healthy profits and provide some space for stocks for larger operation.

In the next few days, Ge Vernova filled the gap and reduced our profits by half. Therefore, we trimmed the other quarter as a defense measure (3)Essence Nevertheless, the action is generally positive, because every day when the stock declines, it is closed on the upper part of its range. This shows that the eager buyer is waiting on the wings.

Hold through income

It turns out that this is the case, Ge Vernova has erupted a new highland (4) And began to run sharply. A few days later, we faced an important decision. The day before the income announcement (5) We have two factors that lead to persistence through income. Ge Vernova increased by 20 % over our admission tickets, so we have a lot of cushions and exactly more than 400 times.

The trader has a high position in Ge Vernova. This is the way hedge saving his trade.

We hope to have more income reactions, but we still get an additional % and we have made profits in the other quarter of this position (6)Essence

Decision for sale

Reach the peak (7)In just three weeks, our Ge Vernova has received 30 % of profits from Ge Vernova. In addition, the 50 -day mobile average extended 25 %. We don't want to lose such a harvest (8)Essence This is an opportunity to lock income and protect our profits, and make the final decision.

Ge Vernova was attacked by 20 % at the Open on January 27. As AI -related stocks plummeted (9)Essence Because we are not greedy for ourselves, we have not suffered devastating profits. In fact, due to the expansion of AI stocks, we have spinned to other fields of retail, medical and software.

Generally, the bad interruption will make Ge Vernova considers at least a few months. But this situation may provide exceptions. When Microsoft CEO Satya Nadella “strike again!” It may change some views on future power when they tweeted. It is worth mentioning how to look at it.

Publers and judges can access Swingtrader more details about past transactions. You can try it for free. Pay attention to nielsen on X, which used to be called Twitter. @ibd_jnielsenEssence

You may also like:

Want to know our swing trading strategy? Watch the update this week.

Want to know the swing transaction? This free online seminar listed it.

Ali Coram shared how she got three digits in the past year

How the investment portfolio manages his investment portfolio risk and makes his stock curve smooth

Together with IBD experts, pay attention to the operation of listing and after the opening