Five key charts watching the global commodity market this week

(Bloomberg) -A even before US President Donald Trump announced its extensive import tariffs on Saturday, he speculated that he would push gold to his month's largest return since March. At the same time, the shale patch activity shows signs of slowing down. Moreover, the climate -centered company's financing transactions are shrinking, even if the global investment in energy transition exceeds $ 2 trillion.

Most of them come from Bloomberg

With the beginning of a week, the global commodity market needs to consider the following five noteworthy charts.

bullion

Since the demand of the airport has helped since January, gold has been hovering at a record height, and its monthly growth has been the best since March. Due to Trump's tariff measures and the potential impact of inflation and global economy, investors have been seeking safety shelter assets. The green weakness of the gold bar is also helping to raise the price of precious metals.

Oil

The largest oil field service company is the largest oil production country in the United States and the United States warning shale activities. It is expected to further decline this year and promote efficiency. In the past year, the number of drilling rigs of petroleum drills can help me measure the country's output measures and show actively to complete the main visual furry count of the occupants. But smaller numbers do not always mean decreased production. LIBERTY ENERGY Inc.'s forthcoming CEO Ron Gusek said in a recent phone call with investors that through the larger team size and the requirements of increasing horsepower, Flak's work has become more and more work powerful.

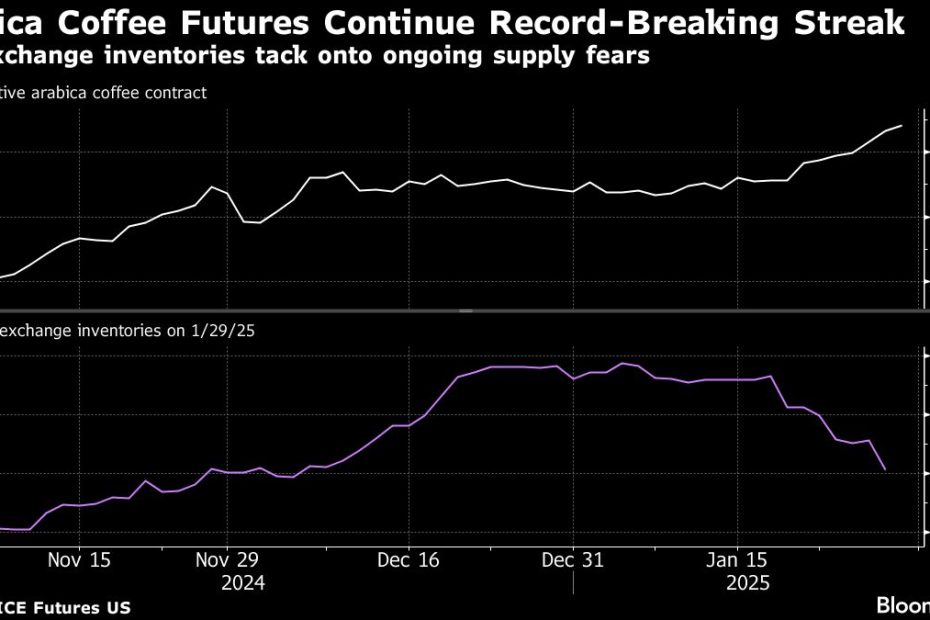

coffee

For coffee drinkers, it seems that there is almost no relief that the price has risen more than 90 % in the past year. The weather difficulties in the main production area have damaged trees, which means that supply will further decrease. Last year, the impact of stickers led to the slowdown in the demand for high -end markets, and consumption remained strong in countries where coffee production. At present, early signs of emerging markets show that consumers are cutting.

natural gas

The rapid depletion of European natural gas inventory makes storage more challenging, especially because the price of natural gas in summer has soared on the supply of next winter. After the natural gas market manager in Germany announced the subsidy proposal to encourage the storage site injection, the situation worsen in late January. The tool aims to help the German market and threaten the establishment of fuel competition between European countries, which has led to a rally of summer prices.