Downing Street says Reeves will remain in parliament

Downing Street said Chancellor Rachel Reeves will continue in her role “across Parliament” as she faces criticism over a falling pound and rising government borrowing costs.

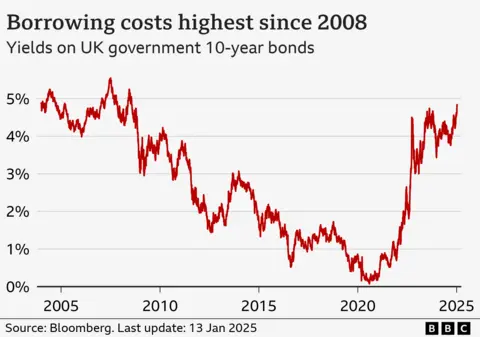

Sterling fell to $1.21 on Monday, its lowest level since November 2023, while a measure of government borrowing rates hit its highest level since 2008.

Borrowing costs are rising in many countries around the world, but some believe decisions in the budget appear to make the UK more vulnerable.

The Tories said the chancellor was “struggling”.

When asked earlier at a press conference whether Reeves would remain as chancellor for the full parliament, the prime minister refused to answer but later said she had “full confidence” and was doing a “fantastic job”.

Conservative leader Kemi Badenock said: “The Prime Minister has simply refused to support the Prime Minister remaining in office.

“Markets are in turmoil, business confidence is collapsing, but the Prime Minister is nowhere to be seen.”

However, the Prime Minister's official spokesman later said: “You received a letter from the Prime Minister this morning.

“He made it very clear that he has full confidence in the Chancellor and that he will be Chancellor of the Exchequer with her across the House.”

The line follows Chancellor defends her decision to travel to China Economic ties with the country are improving despite uncertainty in financial markets.

The Tories said she was “fleeing to China” but Reeves said the deal struck in Beijing would be worth £600m to the UK over the next five years.

Reeves is a central figure in the Labor government and is seen as a reliable lieutenant to voters in the run-up to the election. She also led efforts to build bridges with businesses.

But the business community and some other observers were alarmed by her first budget in October, which they fear could further weaken the economy rather than spur the growth Labor had promised.

Market jitters over the past week have heightened concerns about the government's economic strategy.

Rising borrowing costs will have a knock-on effect on the government's tax and spending plans, as the government will have to pay more interest to finance its existing debt. This leaves less spending on public services and investment.

Trump factor

Governments typically borrow money by selling bonds to large investors such as pension funds. UK government bonds are known as gilts.

The 10-year Treasury yield – the interest rate at which the government repays investors on a 10-year loan – rose to 4.88% on Monday, the highest level in 17 years.

The 30-year Treasury bond yield climbed to 5.44%, the highest in 27 years.

The cost of government debt also rose on Monday in Germany, France, Spain and Italy.

Some experts say investors are reacting to former U.S. president's re-election Donald Trump and his rhetoric about tariffs.

There are concerns that this will lead to more persistent inflation than previously thought, so interest rates will not fall as quickly as expected, either in the United States or elsewhere.

Strong U.S. jobs data on Friday increased expectations that U.S. interest rates will remain elevated for longer, helping to strengthen the dollar's value against other currencies.

However, Emma Wall, head of platform investors at Hargreaves Lansdown, said the UK's problems were not purely caused by global issues and she believed the measures announced in the budget were exacerbating inflation.

“If you can get inflation under control, you'll see interest rates come down in the UK,” she added.

Reeves has also faced questions over her self-imposed rules on government debt and spending, which she said Saturday were “non-negotiable.”

Despite her pledge, some question whether she can achieve her goals without further cuts in spending or tax increases as the cost of government debt rises.

On Monday, Sir Keir said the government would abide by fiscal rules.

However, he added that the government's decisions on the upcoming spending review would be “ruthless”.

Confidence “hurt”

The government has made growing the UK economy a key aim, but recent data shows growth was zero between July and September, before contracting in October.

Businesses have warned that budget measures, such as an increase in employers' national insurance contributions and an increase in the national living wage, could lead to job losses and rising prices.

Rupert Soames, chairman of the Confederation of British Business (CBI), said the situation was “not good” but insisted businesses remained optimistic.

“I wouldn't say confidence is gone,” he told the BBC's Today programme. “I would say it was bruised.”

But he said the government's approach was making the situation worse. Introduction to the Employment Rights ActIt included “strong dissuasion from employment,” he said.

Unions argue the protections introduced in the bill, such as a ban on firing and rehiring, make workers safer, while the government says it “represents the biggest upgrade in employment rights in a generation”.

However, Mr Soames said the bill would lead to job losses.

“Businesses are not just not hiring people, they are firing them,” he said.

As part of driving growth, The government unveiled plans on Monday Make the UK the global artificial intelligence capital by building new supercomputers and other measures.

Sir Keir said the technology had “huge potential” to revitalize Britain's public services, but the Conservatives branded the plans “bland”.