Debt-ridden phone calls surge — but here’s how to deal with it

cost of living reporter

British Broadcasting Corporation

British Broadcasting CorporationCalls to hotlines from people worried about debt surged in January as energy bills rose and credit payments for Christmas expenses came due.

The National Debt Hotline received a 57% increase in calls in the first two weeks of January compared with the same period last year. The first Monday of the New Year was the “busiest ever”, according to the Financial Advice Trust, which runs the line.

The charity said worried callers were often behind on energy and water bills and many owed money to family and friends.

But with many people vowing to tackle unmanageable debt this year, some have taken to social media to document their journey out of debt.

The BBC spoke to people who have owed thousands of pounds to find out how they paid off or are trying to escape their debts.

They join a number of charities such as Citizens Advice and there has been an increase in calls for people to tackle their money problems.

“Use cash whenever possible”

Rachel Hargreaves said seeing other parents posting gifts for their children on Instagram often led her to overspend – even as her mortgage and household bills rose.

Now she is using her social media accounts to document her progress in clearing more than £7,000, and to gain support along the way.

“There's a community. It's nice to talk to people who are in similar situations,” she said.

She said it also helped her take more responsibility for her finances. This includes being aware of how much money is going in and out and reducing impulse purchases.

Using cash rather than cards to specify how much you're spending can help you stay in control, she said.

“Remove card details from online shopping account”

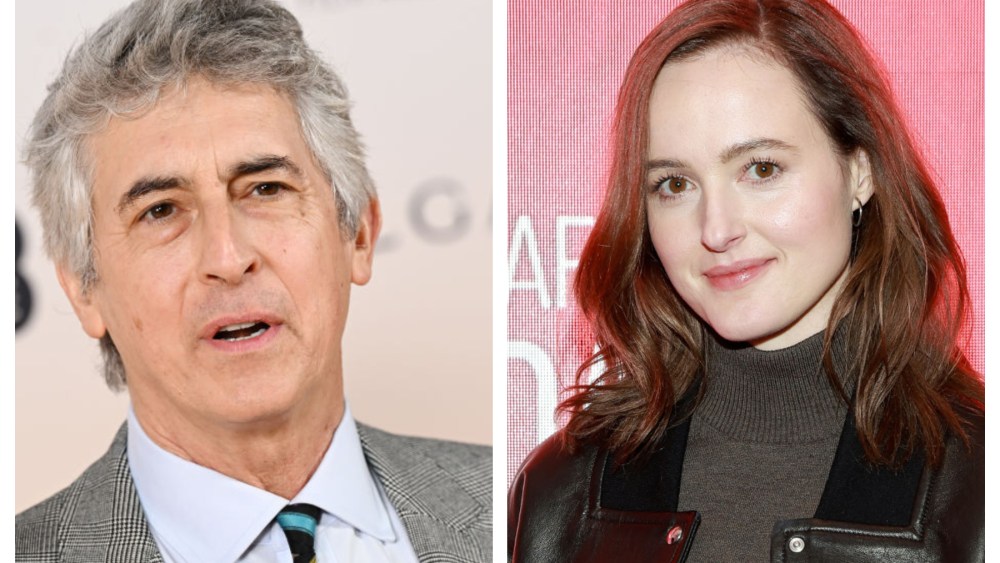

Emma Quinn

Emma QuinnEmma Quinn, 32, suffered from bipolar disorder and experienced periods of mania accompanied by impulsive and reckless behaviour, including spending sprees.

“You get the joy of buying something, and then there's a long, crippling period of depression and self-loathing,” she said.

She once had an income and her credit card debt was manageable, but after her diagnosis her debts soared to a worst-case scenario of £20,000.

“I was suffocating about it, constantly trying to adjust it, but not reducing the debt,” she said.

Eventually, she opened up to her father, saying telling him about her debt was “the worst day of my life.”

Together they cut cards, set account limits or freeze accounts, and develop budgets and payback plans. She is now debt-free, has a mortgage and is saving for retirement.

Emma said she removed her bank card from her online account and deleted details saved on the retailer's website to “slow everything down” and avoid impulse purchases.

She also recommends establishing a trusted contact who can be alerted if there are any large or unusual transactions.

“Don't be proud, ask for help”

When their family building business was hit by rising material costs, Sam and Paul Helsby found themselves in serious difficulty.

When Paul suffered a stroke at age 44, they lost their business and the personal debt associated with it spiraled. The couple soon found themselves £60,000 in debt, with bailiffs manning the door and requests pouring through the letterbox.

“We were afraid to open the curtains. We shut out the world,” Paul said.

They don’t have pictures of the Christmas before because that was a Christmas they didn’t want to remember.

They volunteered at a food bank and met staff from debt charity Christians Against Poverty, which runs a money coaching courses. One night, they sent a text message and opened up to one of them.

“As a carpenter, I’ve always been a problem-solving guy,” Paul said. “Say I can't fix it and you have to let it go and get help.”

Soon after, they received food and energy vouchers and a counselor helped them sort through their financial “mess.”

Paul becomes bankrupt and Sam signs a debt relief order.

Getty Images

Getty ImagesNow they lock their money in virtual funds in bank accounts that are only open on certain days – like a weekly food budget, but also a budget for birthdays, and any extra money in a piggy bank.

This year’s Christmas emphasizes spending time with family rather than money spent on gifts, so January can be a stress-free month.

“Application for Debt Breathing Space”

Rob Smale

Rob SmaleAfter Rob Smale's marriage ended, he said his mental health deteriorated and his finances plummeted.

At one point he owed £35,000 due to multiple credit card purchases and gambling.

The 58-year-old is still looking for work and has submitted more than 300 applications, but his financial situation is now much healthier.

He put it down to “a weird mix of dealing with big and small things” – from knowing when discount yellow stickers are added to items in supermarkets, to asking debt charities for help.

he said breathing space solutionIt gives people temporary freedom from their creditors, which is vital for anyone to gain a sense of control over their finances.

“Ask for help and stay vigilant,” he said. “Sometimes it's just about developing better habits. It's best to stay out of trouble, but don't panic when you get into trouble.”