China’s electric car boom expected to slow in 2025

New electric vehicles are shipped to Belgium at a port in Taicang, east China's Jiangsu Province, on January 11, 2025.

Future Publishing | Future Publishing | Getty Images

BEIJING – China's electric vehicle market will slow sharply by 2025, putting increasing pressure on companies to survive, analysts predict.

Sales of new energy vehicles, including pure electric vehicles and hybrid vehicles, surged 42% last year to nearly 11 million units, according to the China Passenger Car Association. market leader BYDSales of new energy vehicles have soared, growing by more than 40% last year to nearly 4.3 million units, well above its internal target of at least 20% growth from 2023.

But looking forward, HSBC analysts predict that China's new energy vehicle sales will only grow by 20% this year, and industry consolidation will also intensify. They expect BYD sales to grow by about 14%.

Ding Yuqian, head of China automotive research at HSBC, said in a report last week that strong sales allowed “struggling players and laggards” to persevere despite falling profit margins. She pointed out that only BYD, Tesla and rickshaw Achieve profitability in 2023.

“We believe this situation is unsustainable and we expect the pace of industry consolidation to accelerate rapidly,” Ding said.

China's subsidies and consumer purchase incentives have supported the rapid growth of new energy vehicles in recent years.

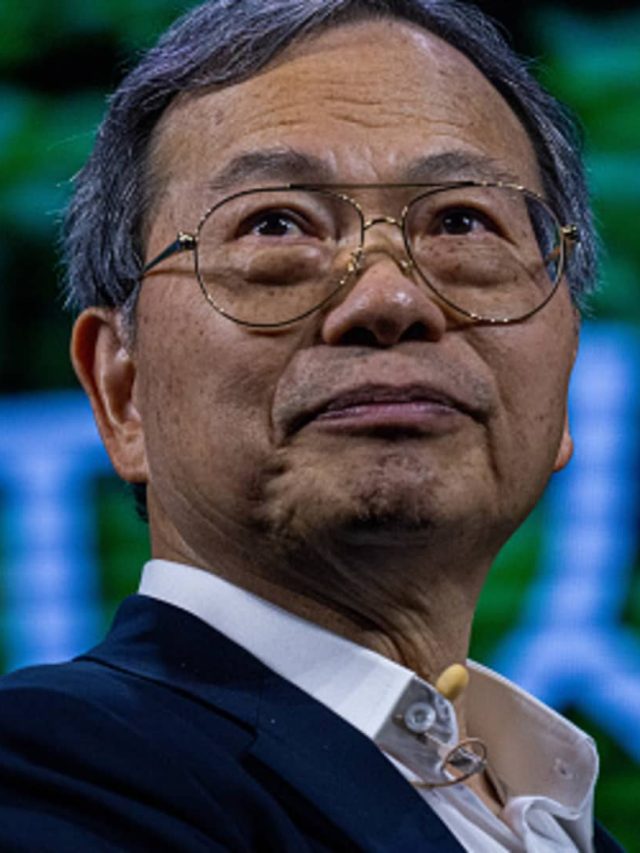

Guangfeng Technology, a Shenzhen-based laser display company, didn't even have an automotive business until it started producing car projector screens and started shipping them in China early last year. The company shipped more than 170,000 units last year.

But Li Yi, chairman and CEO of Guangfeng Technology, told CNBC last week that the company expects sales to reach similar levels in 2025, a sign that the market is changing. He doesn't expect the market to pick up until 2026.

“A lot of customers, automakers, their financial situation is not good. They have cut their R&D budgets. This will definitely have a negative impact on the industry,” Li said, also pointing to overcapacity issues.

As automakers rush into China's fast-growing electric vehicle market, they are engaging in price wars to attract customers. Smartphone company Xiaomi launched its SU7 electric sedan last year, which costs $4,000 less than the Tesla Model 3 and claims longer range.

“When BYD and Tesla cut prices, most competitors had no choice but to follow suit,” said HSBC's Ding. “This obviously squeezed the overall profit pool of the auto industry, especially now that electric vehicles are gaining momentum,” he said. pointed out that BYD has a net profit margin of just 5%, lower than the teens achieved by top automakers during the heyday of traditional fossil fuel vehicles.

Association data shows that as of the second half of this year, the penetration rate of new energy vehicles in new car sales has exceeded 50%.

Fitch Bohua analyst Zhou Wenyu and his team said that due to high penetration rates, new energy vehicle sales growth may slow to 15% to 20% in 2025. They expect so-called smart features to increasingly become the main focus of competition.

China's automakers are increasingly turning to in-car entertainment features and driver-assist technologies to differentiate their vehicles.

Although growth in the electric vehicle market is slowing, Guangfeng Technology plans to launch a 4K resolution projector in China this year, as well as a screen with better contrast and privacy features, Li said.

In the long term, the company intends to develop new uses for laser-based automotive headlights within the next two to three years, Li said. He added that the company was in talks with Tesla about projector-type products in next-generation cars, but could not reveal more information due to a confidentiality agreement.