Artificial intelligence agents will arrive in 2025. Here are my top stock picks to take advantage of the next wave of artificial intelligence investing.

Generative artificial intelligence (AI) is an incredible technology, and we've only scratched the surface of its potential. Currently, it is used as a program for normal work, but it is about to enter a new phase: Agentic AI. Agent AI, often called AI agents, involves setting up software programs to complete tasks typically performed by humans. Implementing the next phase of artificial intelligence is critical as it will allow those at the forefront to do more with fewer resources.

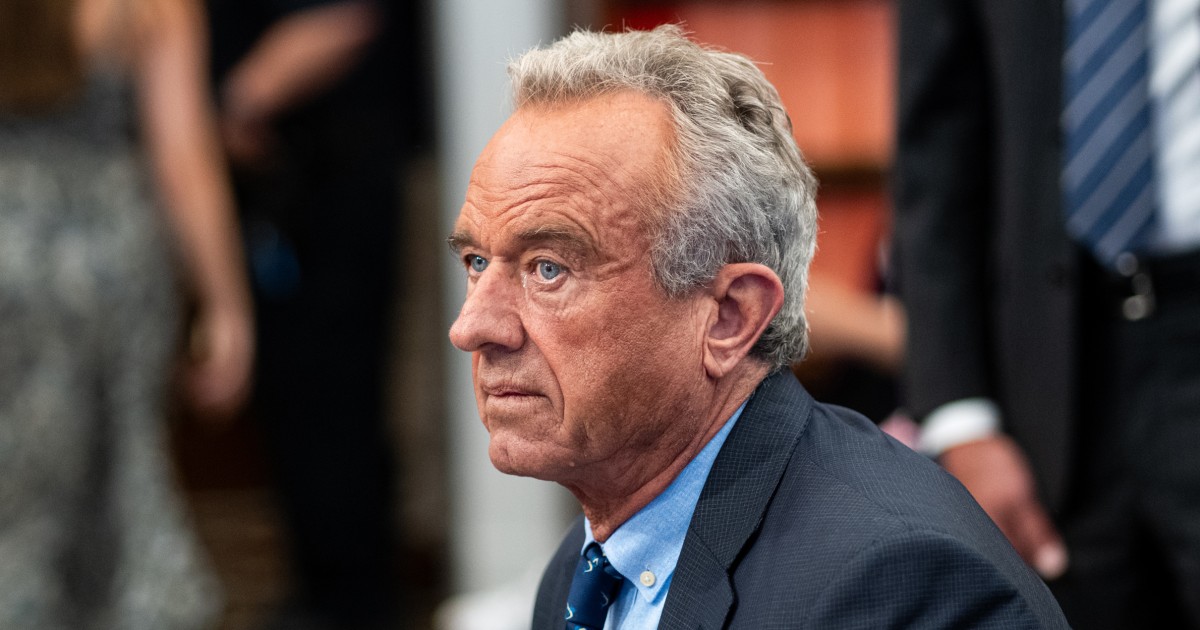

One of the leaders in agent artificial intelligence is salesperson (NYSE: CRM). The software company is making a big push for and integrating agent artificial intelligence, and it also has one of the best platforms for doing it.

Salesforce produces customer relationship management (CRM) software. CRM is a very broad field, but can generally be summarized as business interactions with potential customers from the marketing stage to post-sales support. A lot happens between these two points, and Salesforce software supports you along the way.

Many customer interactions can be automated with AI agents, which is why agent AI is a huge trend for Salesforce. As with most software-as-a-service (SaaS) companies, the more add-ons included in a base package, the higher the price. This kicks off another milestone in the generative AI trend; we have reached a stage where many companies are starting to monetize their AI investments.

Marc Benioff, CEO and co-founder of Salesforce, is very bullish on agent AI. “This is what artificial intelligence will be,” he said at the company's 2024 Dreamforce conference. It's a big statement, but the company's ability to increase efficiency and free up employees to do tasks that require original thinking is important to many. It will be a huge change for the workforce.

However, does this technology have the power to propel Salesforce stock prices to new heights?

Salesforce is a mature software company that began pivoting from growth at all costs to maximizing profits a few years ago. However, its sales growth has been a bit slow over the past few quarters by the standards of most software companies. Revenue in the third quarter of fiscal 2025 (ended October 31) increased 8% year-over-year to $9.44 billion. Earnings per share (EPS) were $1.60, compared with $1.26 a year ago, an increase of 27%.

Earnings per share growth outpaced revenue growth as Salesforce's profit margins continued to rise. In the third quarter of last year, Salesforce's operating margin was 17.8%. This year, its operating margin was 20.6%. This will be a key trend to watch, as some of the most profitable software companies' profit margins can reach 30%. It may take a while for Salesforce to get to that level (if it ever does), but if it does, shareholders will be happy.