How does Donald Trump's tariffs affect Britain?

British Broadcasting Corporation

British Broadcasting CorporationDonald Trump is still unclear whether he will impose tariffs on Britain, but economists have warned that even if he avoids directly attacked, Britain may still be negatively affected by the extensive trade policy of the president.

The growth rate of some important trading partners in the UK can feel this impact. Industrial exports can be transferred from the United States and submerged the British market, which may affect our financial markets, including increasing the cost of lending.

When asked about future tariffs, Trump told Broadcasting Corporation on Sunday night: “Britain has lost its line, but I dare to be sure … I think it can solve a problem.”

The president did not treat Britain as “unsuitable” in any way.

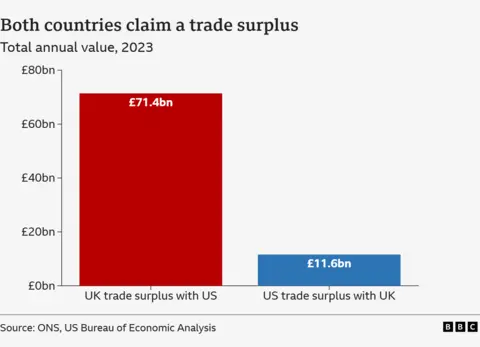

One of the reasons for Trump's tariffs on the state is that they have trade surplus with the United States-in other words, their stocks sell to the United States more than imported from the United States.

He claims that these trade surplus It is equivalent to “a lot of subsidies we provide to Canada and Mexico.”

On Monday, Trump suspended Mexico's tariffs for a month, but the president complained that the transaction with the EU was unbalanced. Speaking on Sunday: “They don't take our cars, they don't take our agricultural products, and they have almost nothing. We took away everything. Millions of cars, a lot of food and agricultural products.”

Therefore, if Britain also trades trade surplus with the United States, it may be seen in a way that Britain stands out in Trump's mind.

Does Britain have trade surplus with the United States?

British National Bureau of Statistics estimate Britain's trade surplus with the United States in 2023 is about 71 billion pounds, which is the latest year we have data.

However, the US Bureau of Statistics (US Economic Analysis) estimates that in that year, the trade surplus between the United States and the United Kingdom was about $ 14.5 billion, about 1.2 billion pounds.

How could the two be true?

These two statistical agencies have studied this difference and agreed to be due to different ways to measure trade.

One factor is British institutions. Unlike the United States, British institutions are not included in British official dependence (for example, some of them are important financial service hubs) and significantly affect the overall figures.

Another key to the measurement of service trade (such as banks and finance), which is opposite to physical goods, seems to be different.

But the most important thing is that there is still a certain degree of uncertainty about what is the overall difference between driving statistics and the exact difference between the problems that the two institutions are trying to solve.

At the same time, the British government will undoubtedly hope that President Trump prefers to use US data, which shows that the sales of the United States to Britain exceed the purchase-and will focus on goods instead of serving trade.

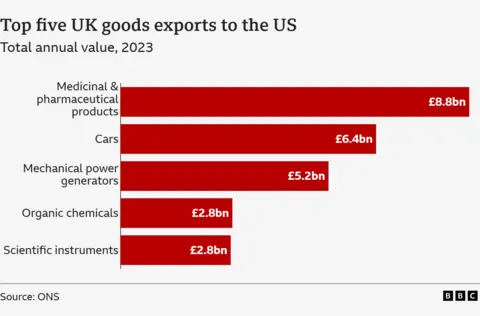

If the president wants to impose a blanket tariff on Britain's exports to the United States, it will Products that affect about 60 billion pounds According to British data, it was sent in 2023.

In that year, pharmaceutical products accounted for 8.8 billion pounds of British goods exports, with £ 6.4 billion and 6.4 billion pounds for generating machinery.

Although the direct impact of tariffs is to reduce the prices of these imported goods to American companies and consumers, they may reduce the demand for them over time over time. This may be possible The negative impact on the export of British companiesEssence

How will Britain be affected?

In other ways, Britain may be negatively affected by tariffs from other countries.

The global economy, especially the EU, has a slower growth-Britain is still about half of its trade, which will hinder Britain's prospects for growth.

If our trading partners are in a decline due to tariffs, analysts said that they will reduce interest rates and their currencies will decline, which will make Britain's export to them more expensive.

Ahmet Kaya, the National Institute of Economics and Social Sciences (NIESR), said: “The United States impose tariffs on our other trading partners, and will still have a British economy on the supply chain and exchange rate on the supply chain and exchange rate. Negative impact. “

NIESR estimates that the US threat to 25 % of tariffs on Mexico and Canada may reduce the British GDP growth by 0.1 percentage points in 2025.

Some economists have warned exports- For example, steel made in China -It due to the new tariffs, this may be transferred from the US market, it may be sold below production costs, or it can be “dumped” in the British market, which may have a negative impact on the sales of British steel manufacturers.

Some analysts say that due to tariffs, US interest rates may also overflow to the British borrowing market.

One of the reasons for the British government's loan cost or gold -plated income Temporarily rising in JanuaryIt is because US government bond yields have also increased.

“The main threat of Trump tariffs to the British economy is likely to be the overflow of the US interest rate rather than the tariff itself,” Economist Julian Jessop saidEssence

“The yield of the US and British government bonds is now locked again. If the Fed (Central Bank of the United States) is even more unwilling to reduce the tax rate of the United States, then the borrowing cost may be longer in the UK.”

Higher borrowing costs may slow down the British economy and put pressure on the British government, requiring to reduce public expenditure or increase taxes in order to comply with the borrowing rules it chooses.