Forget about soft landings, keep flying

Wayne Cole's outlook on the day ahead for European and global markets.

Why bother designing a soft landing when you can keep flying?

That's information from the U.S. nonfarm payrolls report, which is likely to raise the Atlanta Fed's GDP Now forecast from an already above-trend 2.7%.

With the labor market so resilient and inflation slowly coming back down, markets may be wondering why the Fed is easing policy. Wednesday's core consumer price index above +0.2% could convince futures to start giving up on even one rate cut this year.

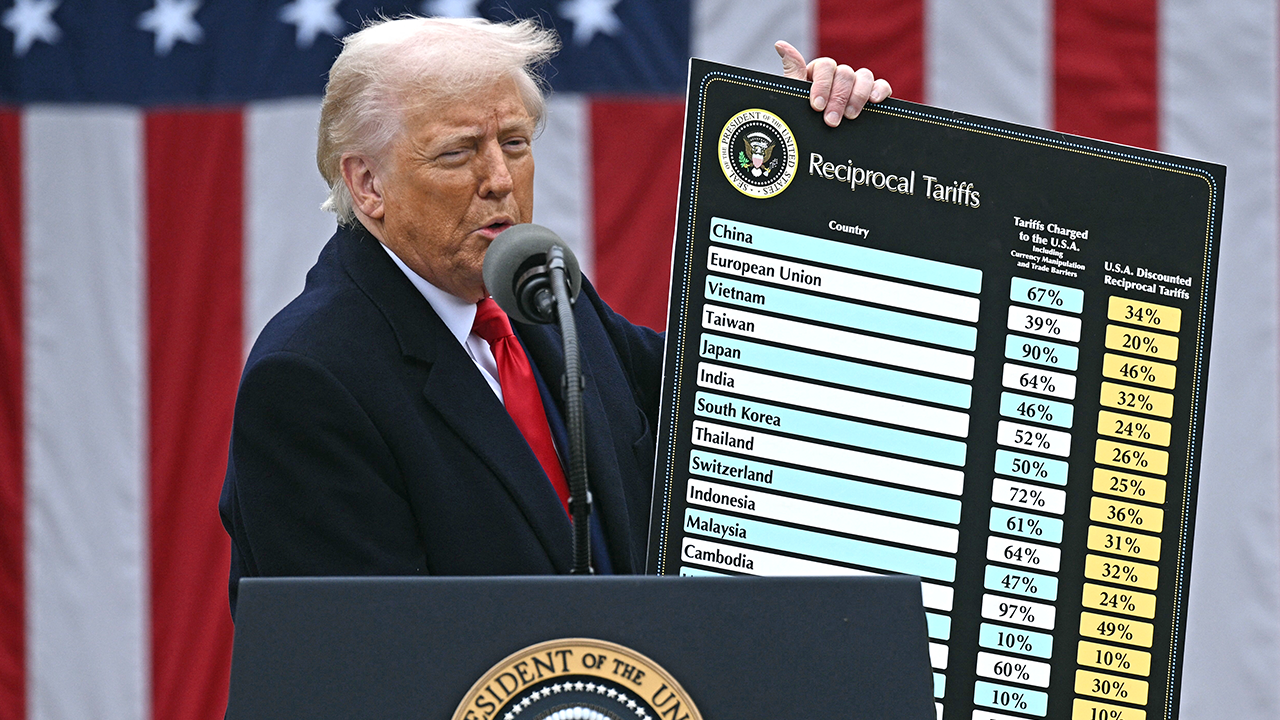

The Treasury market is clearly concerned that the cuts are complete and that action could be taken next, especially if President-elect Donald Trump enacts widespread tariffs, mass immigration deportations and tax cuts.

China's announcement of a US$105 billion trade surplus with the United States in December only added ammunition to those advocating adjustments to tariffs.

Add to that a growing budget deficit, and it's no surprise that the 10-year Treasury yield is testing the 5% mark.

That raises the bar for corporate earnings discounts, just as earnings season kicks off for the big banks on Wednesday. This also makes risk-free debt relatively more attractive compared to other investments such as stocks, cash, real estate and commodities.

As a result, Asian stocks are almost entirely in the red so far on Monday. Japan is on holiday, but Nikkei futures fell about 1.2%. S&P 500 and Nasdaq futures were both down around 0.5%, while European stock futures were down between 0.1% and 0.3%. There were no physical Treasury trades, but futures prices were down about 5 basis points.

Rising yields are fueling a bull run in the dollar and putting pressure on Asia as a whole, where central banks must intervene regularly to support their currencies.

China's central bank is stepping up its efforts to find policy tools to support the yuan, announcing on Monday it would raise limits on overseas borrowing by local companies. If they can borrow the dollars they need, there will be less need to use yuan to buy dollars in the spot market.

Another currency under attack was the pound, which fell to a 14-month low of $1.2138 amid concerns over the Labor government's financial credibility. During a visit to China, Finance Minister Rachel Reeves had to reassure the media that she would take action to ensure the government's fiscal rules were followed.

Oh, and oil prices rose another 1.5% as investors pondered the full impact of the latest round of US and UK sanctions on Russian producers.

The move may indeed have an impact, as it sanctions an additional 160 tankers in Russia's shadow fleet, bringing the total to 270. Previous tankers so attacked had their sailing range severely restricted, and some were eventually scrapped.