California wildfires hobble its insurance market: NPR

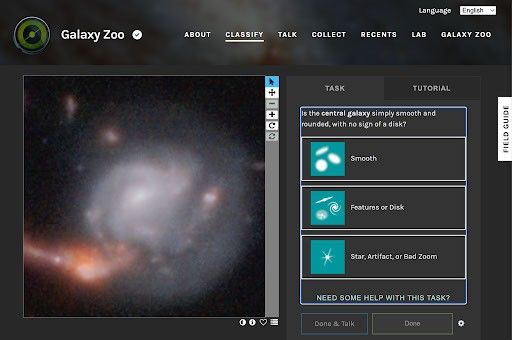

Kwynn Perry, her son Ellison and husband Brian at their former home in Altadena, near Pasadena, California.

Greg Allen/NPR

hide title

Switch title

Greg Allen/NPR

ALTADENA, Calif. — Kwynn Perry came to her home this weekend for the first time since the Eaton Fire. Only ashes and rubble remained.

“This is our bedroom,” she said. “That was our bed, my antique bed.” Now it's just a dark, twisted ruin.

Perry and her family rented the home and always had renters insurance to cover the costs of moving and replacing the property. That is, until last year. “We were told that no one was insuring renters in this way. So, we had no choice,” she said. Without insurance, Kwynn, her husband Brian and son Allison relied on FEMA and a GoFundMe page.

In recent years, insurance companies have begun using sophisticated computer modeling and artificial intelligence to calculate risks in fire-prone areas. That led to several companies halting new policies for homeowners and renters in places like Altadena and Pacific Palisades. “They really have to limit coverage so that when we have a disaster like Los Angeles, they can pay claims,” said Janet Ruiz of the Insurance Information Institute.

In addition to the destruction of lives and homes, the Los Angeles wildfires will also have a huge impact on California’s insurance market. It is estimated that insured losses from fires exceed $20 billion.

California law requires insurance companies to keep enough reserves to pay claims even in the event of a disaster such as this type of fire. As a result, former California Insurance Commissioner Dave Jones doesn't expect the incident to bankrupt any companies. “As people in the industry have said, this is going to be a profitability event for them, which means they're certainly not going to be profitable this year,” said Jones, now at the Center for Law, Energy and the Environment at the University of California, Berkeley.

But homeowners must also help pay for the fire.

Kwynn Perry's home in Altadena is now nothing but ashes and rubble.

Greg Allen/NPR

hide title

Switch title

Greg Allen/NPR

Because insurance companies stopped writing new policies in these areas, many homeowners were forced to purchase coverage under California's FAIR plan. This program, often called an insurance company of last resort, is a program developed by the state and funded by industry. Jones said so many homes in Pacific Palisades are covered by FAIR that it could run out of money. If that happens, the program will impose special assessments on home insurance policyholders across the state.

Additionally, under new regulations recently adopted by the state of California, insurance companies can use computer modeling risk analysis to set higher rates—something that was not previously allowed. “There's no question that before these wildfires happened, they … were going to raise rates further. Now, with these wildfires happening, they're going to be able to ask for higher rate increases,” Jones said.

The new rules also require insurers to continue writing new policies in fire-prone areas. Last week, California’s insurance commissioner issued a moratorium prohibiting insurance companies from canceling or not renewing policies for next year in affected areas.

Amy Bach of the consumer group United Policyholders worries these catastrophic fires will hinder insurers from returning to the market in places like Pacific Palisades and Altadena. “Psychologically,” she said, “this disaster couldn’t have come at a better time to give insurance executives renewed confidence in doing business in the state.”

That's bad news for Perry Bennett in Altadena.

The building he owned was home to “The Little Red Hen,” a coffee shop now reduced to a brick and ashes. “It's going to be very difficult to get insurance for the Little Red Hen because of what just happened. I think even if you rebuild, it's going to be very, very difficult. Getting insurance is going to be difficult, or it's going to be really expensive,” he said. . “

Bach, the consumer advocate, has another concern — people who may decide to drop their coverage. “For some people, certainly low-income people living in homes they inherited, they might just say my house price is too high, I can't afford it… $10,000 a year, $15,000 a year, ” she said. “We may find that some of these people are uninsured.”

As insurance costs continue to rise, Bach and others worry more people will try to drop their coverage.